Launch is the community where the next generation of Romanian founders and talent in tech grows. Launch is a community building initiative by How to Web, Google for Startups, InnovX-BCR. At the moment, more than 500 founders and contributors are part of Launch. We’re here to help you to grow too, so let us know what can we do for you! #FoundersLove #LaunchLove #LaunchCommunity

This report comes as an effect of a need we had for many years now, that is a need which we know founders feel it too, namely to have a common understanding of the state of Romanian-born early stage startups.

“Through this endeavor, our goal is to outline the Romanian founder’s journey with all the good, the bad, and the great they’re equipped with, in order to inspire the aspirational founders who want to make their way into the tech scene.” Alexandru Agatinei, CEO How to Web, co-organizer Launch

The survey we applied for the data collection purpose was aimed to let founders’ personal experience unveil the reality that they and their peer startup founders share.

“Romanian-born early stage startups and the Romanian startup ecosystem represents one of the main catalyzers of innovation, significantly impacting Romania’s economic growth. Google for Startups’ mission is to support local startups by supplying advanced technologies, knowhow and resources needed to grow and scale globally.

Having alongside our journey partners such as Launch thus creating a proper space for Romanian founders of early stage startups to grow.” Silvia Carasel, Project Manager Google for Startups & Grow with Google Romania, co-organizer Launch

We consider a breakthrough moment to have a clearer picture of the reality founders live in by looking at various dimensions of a founder’s journey – product building, team formation, bootstrapping, sales, marketing, fundraising, hiring, scaling, and everything in between.

“We all needed to take this deep-dive into the reality of Romanian-born early stage startups. Why? Because now more than ever it’s important to tune in to what founders have to say in order to understand the problems and challenges they’re facing and therefore do our best to better support their endeavours from the beginning and therefore increase the likelihood of building innovation.” Anca Luca, Community Manager InnovX-BCR, co-organizer Launch

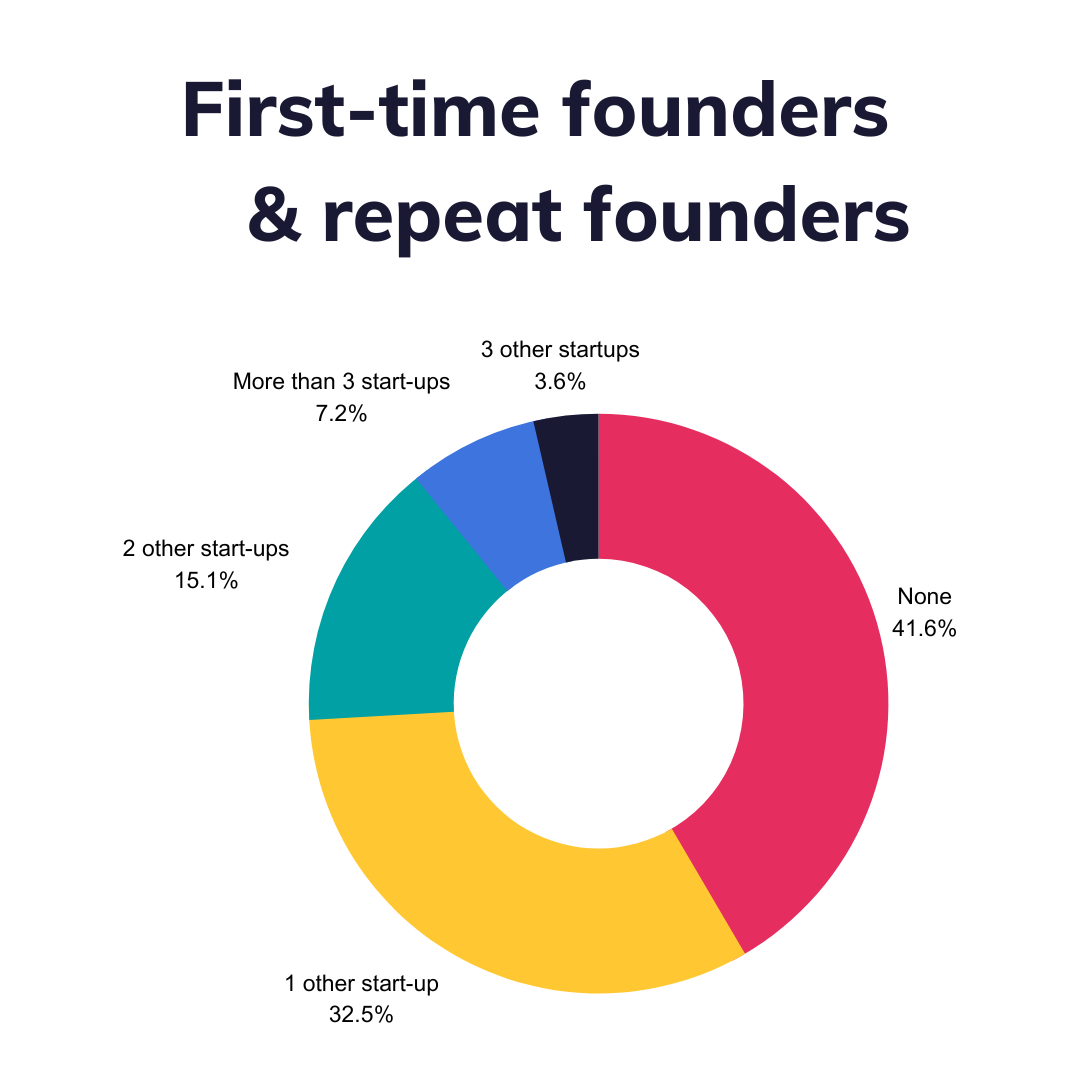

The reality check starts with looking into the first-time founders vs. repeat founders dimension of the Romanian-born early stage startups.

The founding team’s previous founding experience is a critical ingredient to a company’s future success. This applies generally in entrepreneurial companies, but especially in startups. We were inspired in collecting and analyzing this type of data by Ali Tamaseb’s research turned into the book called “Super Founders”.

Therefore when we looked at the data we were impressed to discover that the majority of founders in the data set (58.4%) are serial / repeat founders and another 41.6% of the data set was represented by first-time founders.

Going in-depth we could also breakdown the sub-segment of repeat founders as follows:

While all in all this means that there is a significant pipeline of Romanian-born startups kicked-off by repeat founders there’s also a strong positive signal that first-time founders are strongly represented among founders of Romanian-born early-stage startups.

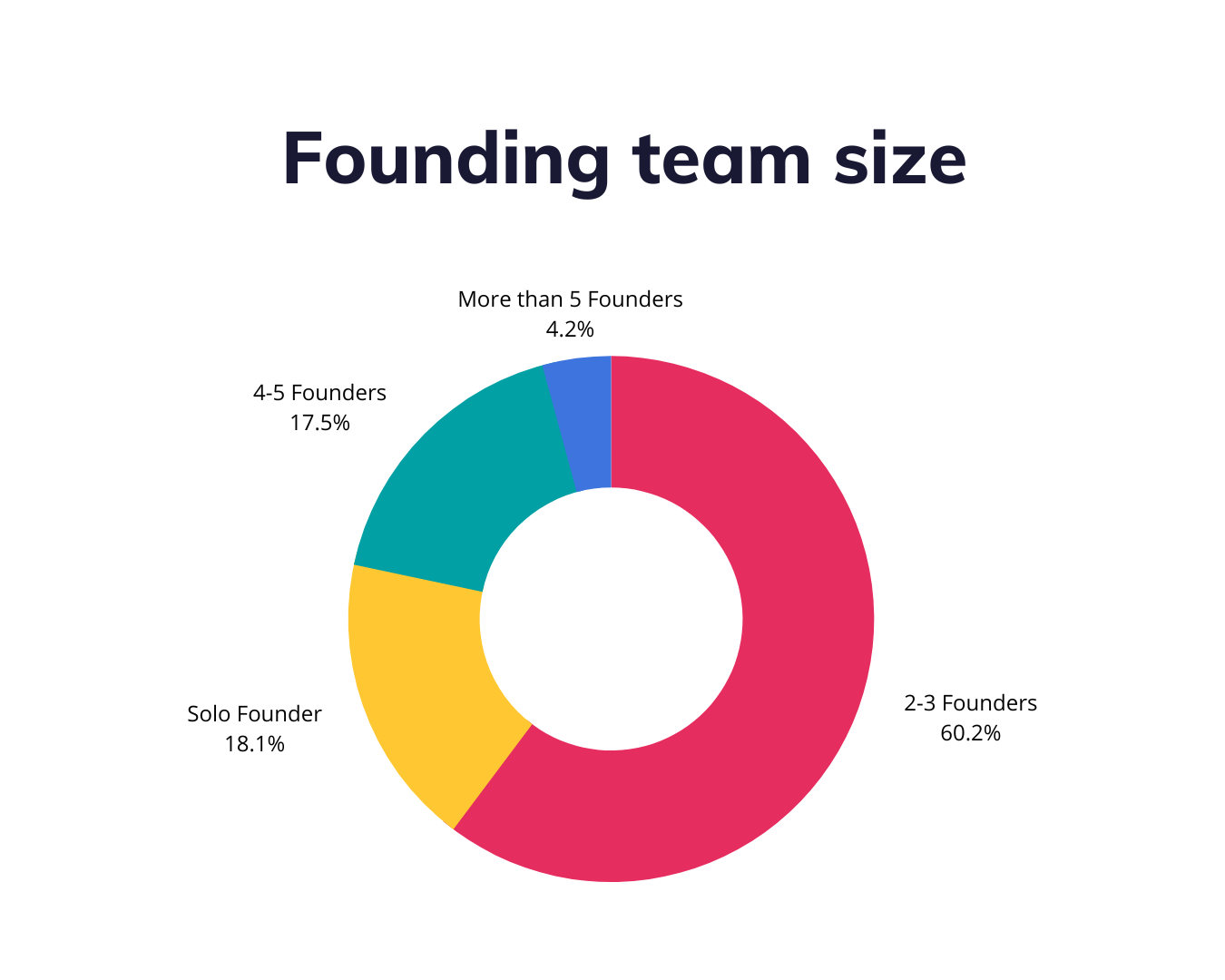

Contrary to popular belief, when looking at the team size dimension we came to the conclusion that a large majority of early-stage startups are founded by teams (81.9%) and not by solo founders (18.1%).

Going in-depth we could also breakdown the sub-segment of startups founded by teams as follows:

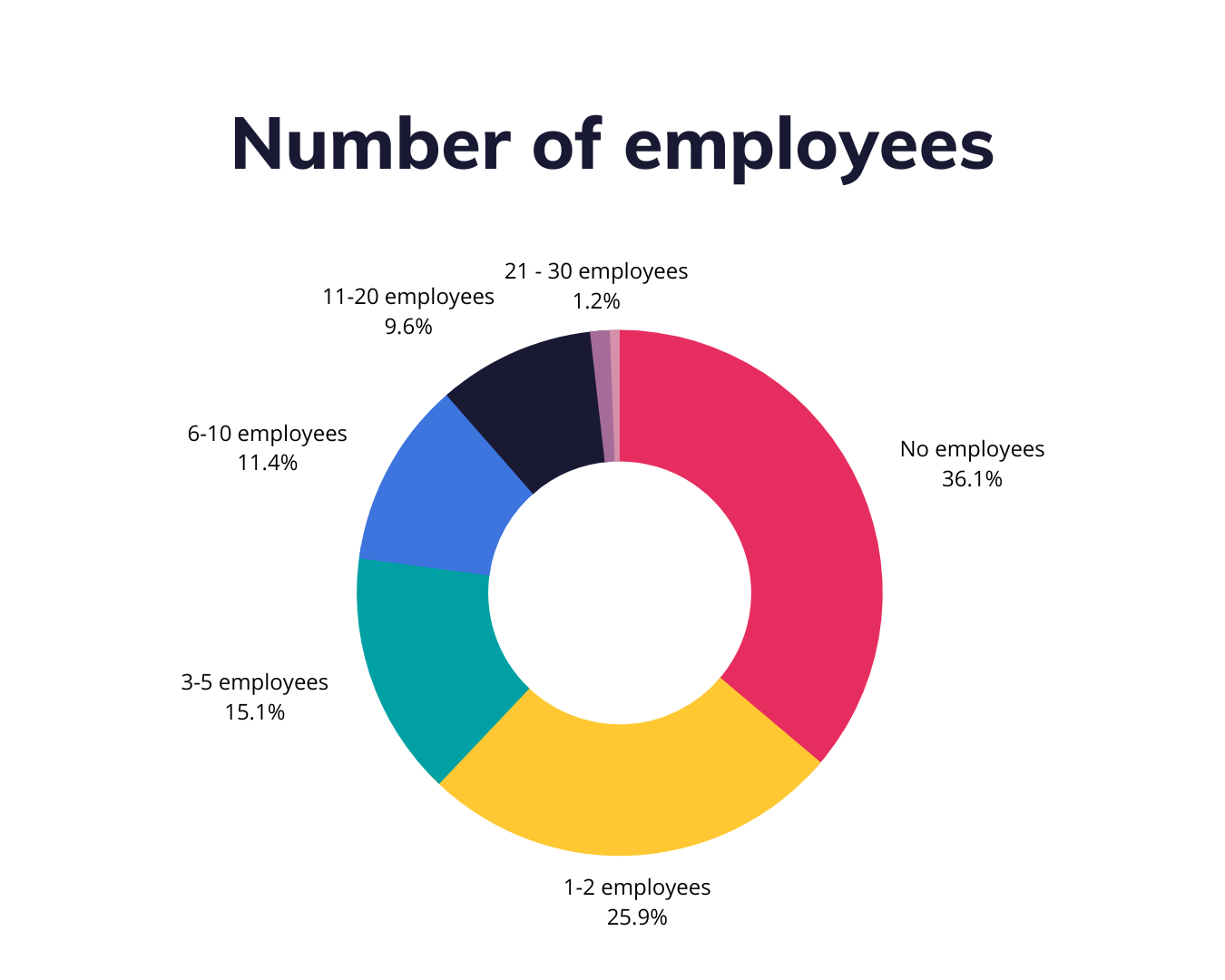

In a similar line to the founding teams we found out that a significant majority of the early stage startups in our data set do have employees (63.9%) as compared to the one that don’t (36.1%).

Going in-depth we could also breakdown the sub-segment of startups having employees as follows:

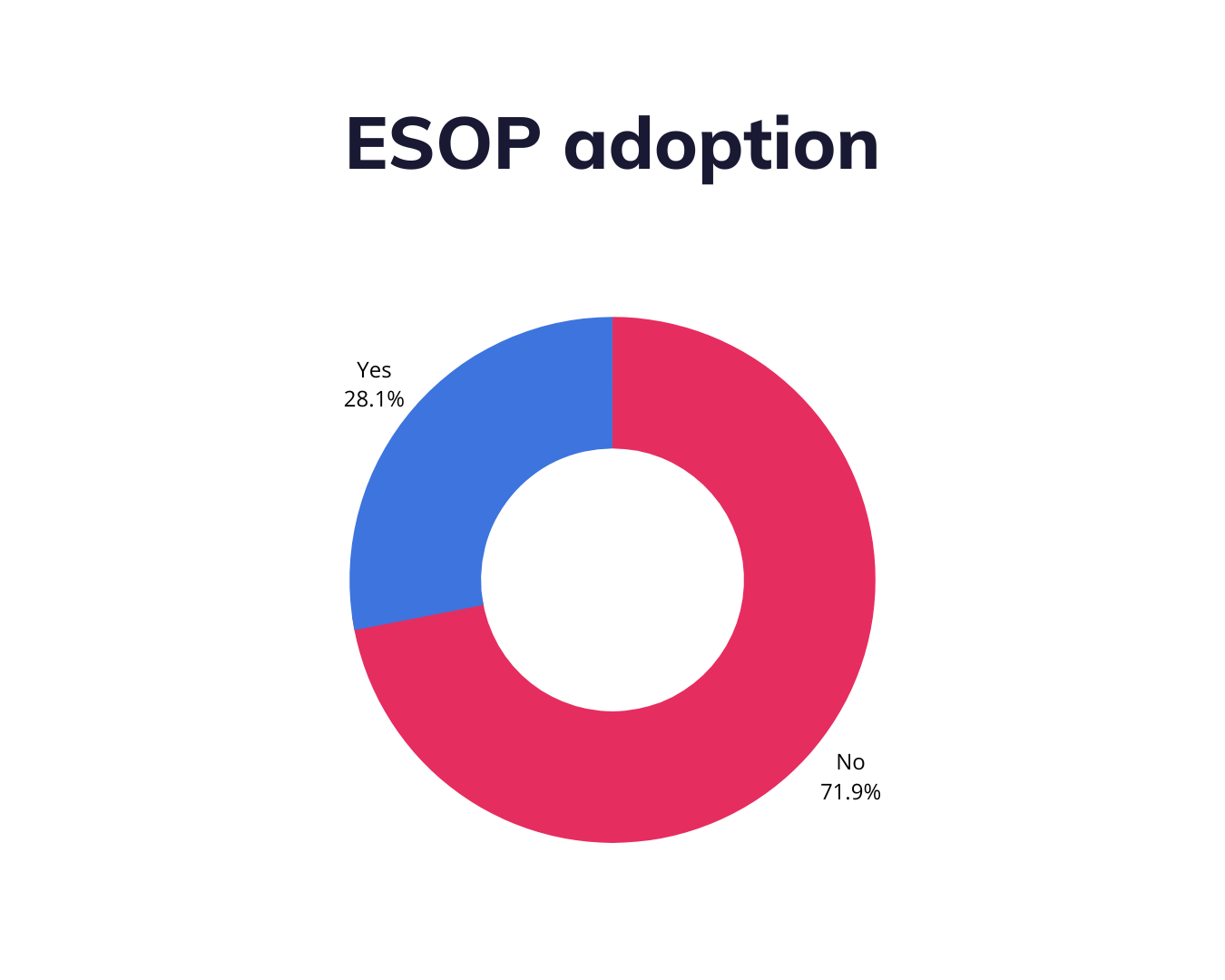

We previously learned that the majority of Romanian-born early stage startups do have employees in their teams. Given this fact, we were struck to find out that an impressive majority of them still did not implement ESOP (Employee Stock Option Plan) within their teams (71.9%) in contrast with those who did implement ESOP (28.1%).

It comes as a surprise while ESOP can usually strengthen the early stage startups recruitment offering. Equity can be a huge incentive for joining a startup early, but knowing when to exercise your options, how to get paid out, how much you’ll make, and how much you’ll get taxed is not at all obvious. It’s important to have a solid understanding of how options work, because the way you use them can have huge financial consequences.

Options can be quite a confusing topic and unfortunately, many employers don’t do a great job of explaining them. But with new born companies also offering help in this space (i.e. GoodLegal etc.) we expect that the knowledge gap will be bridged and the aversion of founding teams towards operating a form of stock sharing will soon become a thing of the past.

Also here are some questions to ask your employer when you’re finally receiving stock options, here’s a checklist to go through with your employer anytime you receive an option grant – the list below is an excerpt from Ben Beltzer’s Medium article “Understanding Startup Stock Options”:

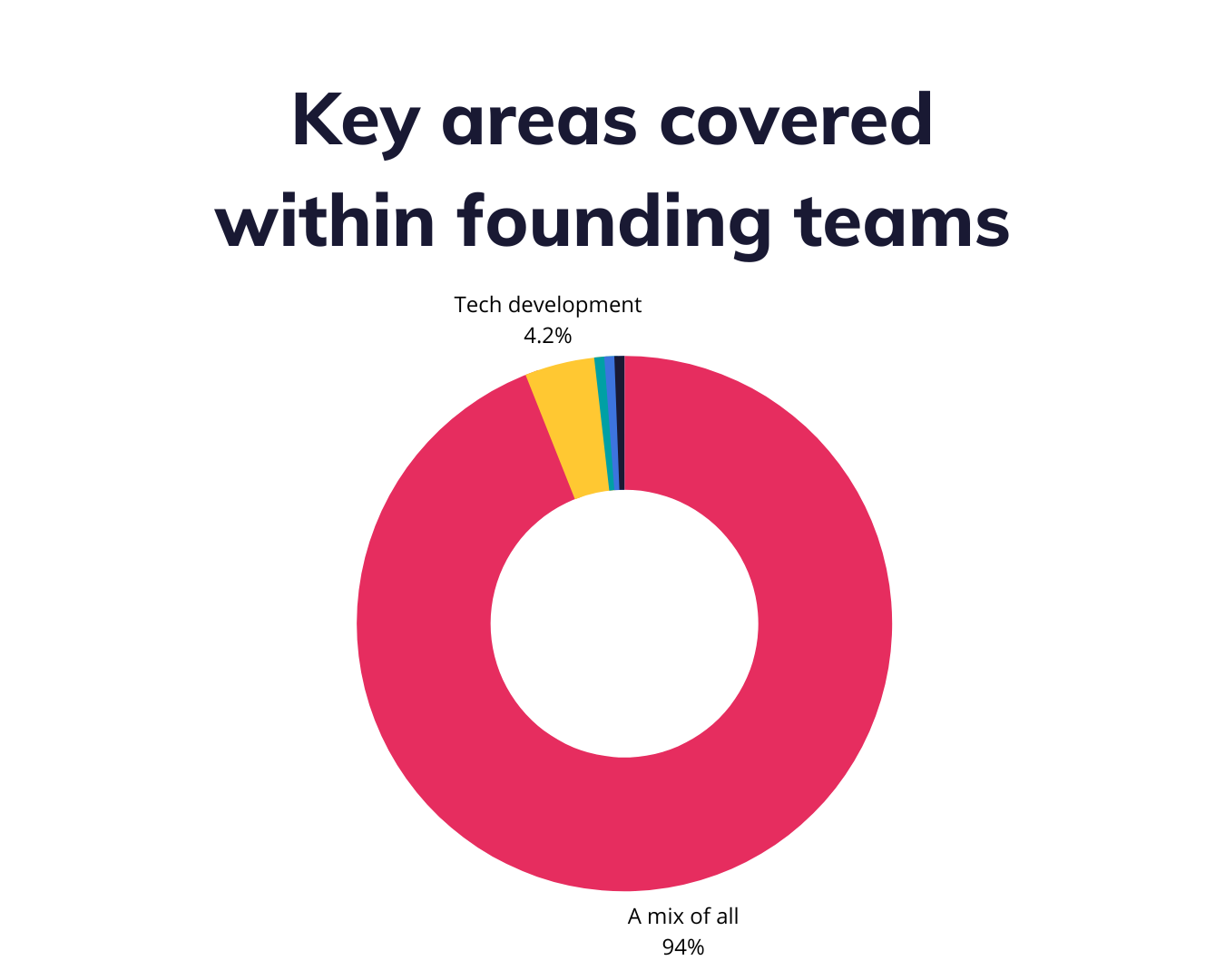

It’s no surprise that founding teams of early stage startups are made of jacks of all trades. We could notice this trait of the founding teams of the Romanian-born early stage startups we’ve gathered our dataset for the purpose of this report.

In 94% of the cases, the founding teams of Romanian-born early-stage startups cover a mix of all / some of the following areas: Tech development, Product, Finance, Communications & PR, Sales, Marketing, UX / UI, Design, Recruitment & HR.

For the remaining minority of the founding teams that don’t cover a wide range of areas, we could see that Tech development, Product, Finance, Communications & PR are represented as follows:

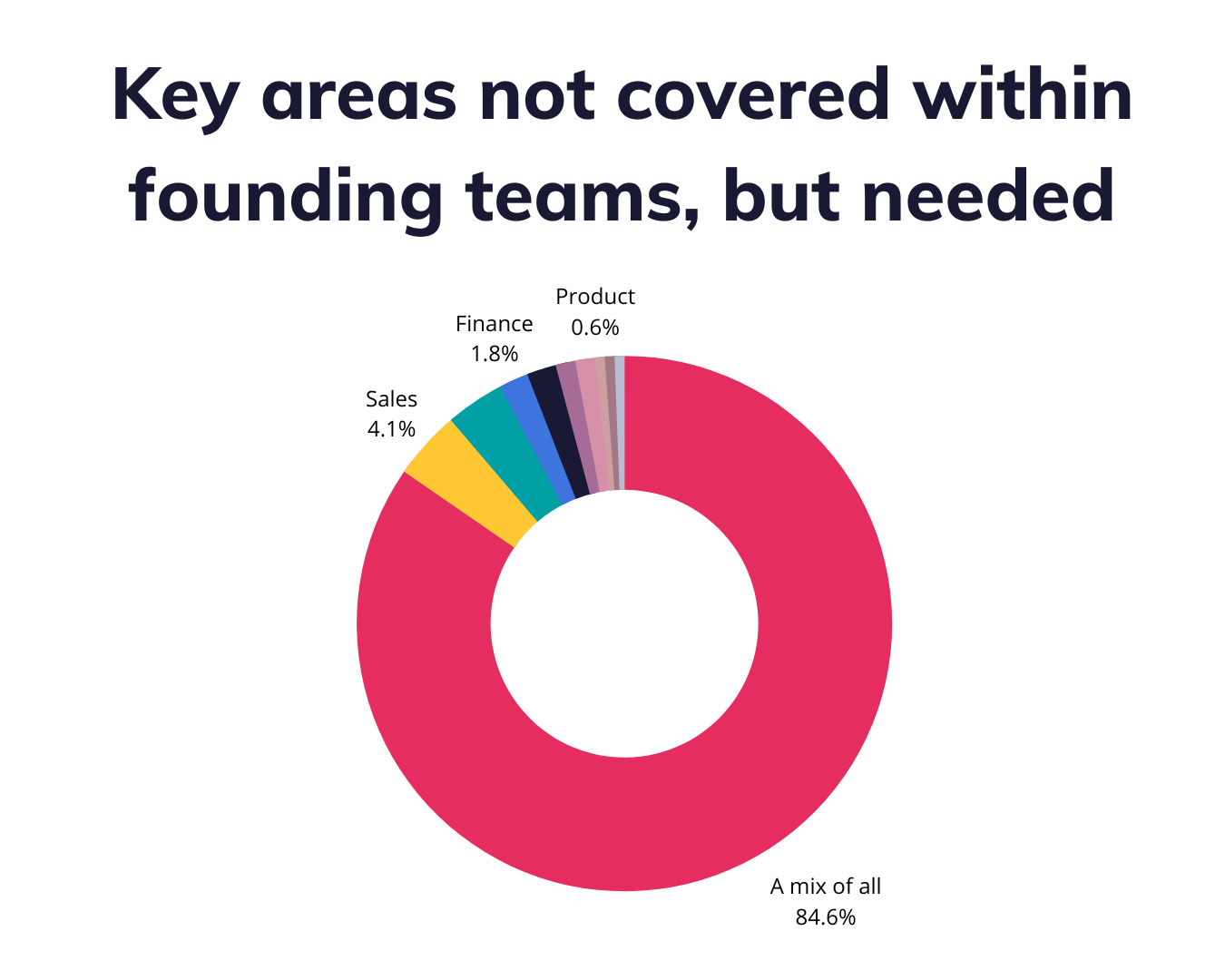

In contrast to the key areas covered by the founding teams we could also find out which areas are not yet covered by founding teams, but needed at the moment.

We were stoked to find out that 84.6% of the founding teams still don’t cover, but need either co-founders or key hires to cover the following areas: Sales, Tech development, Finance, Communications & PR, Marketing, Recruitment & HR, Product, UX / UI, Design.

For the remaining minority of the founding teams, we could see that Sales, Tech development, Finance, Communications & PR, Marketing, Recruitment & HR, Product, UX / UI, Design are represented as follows:

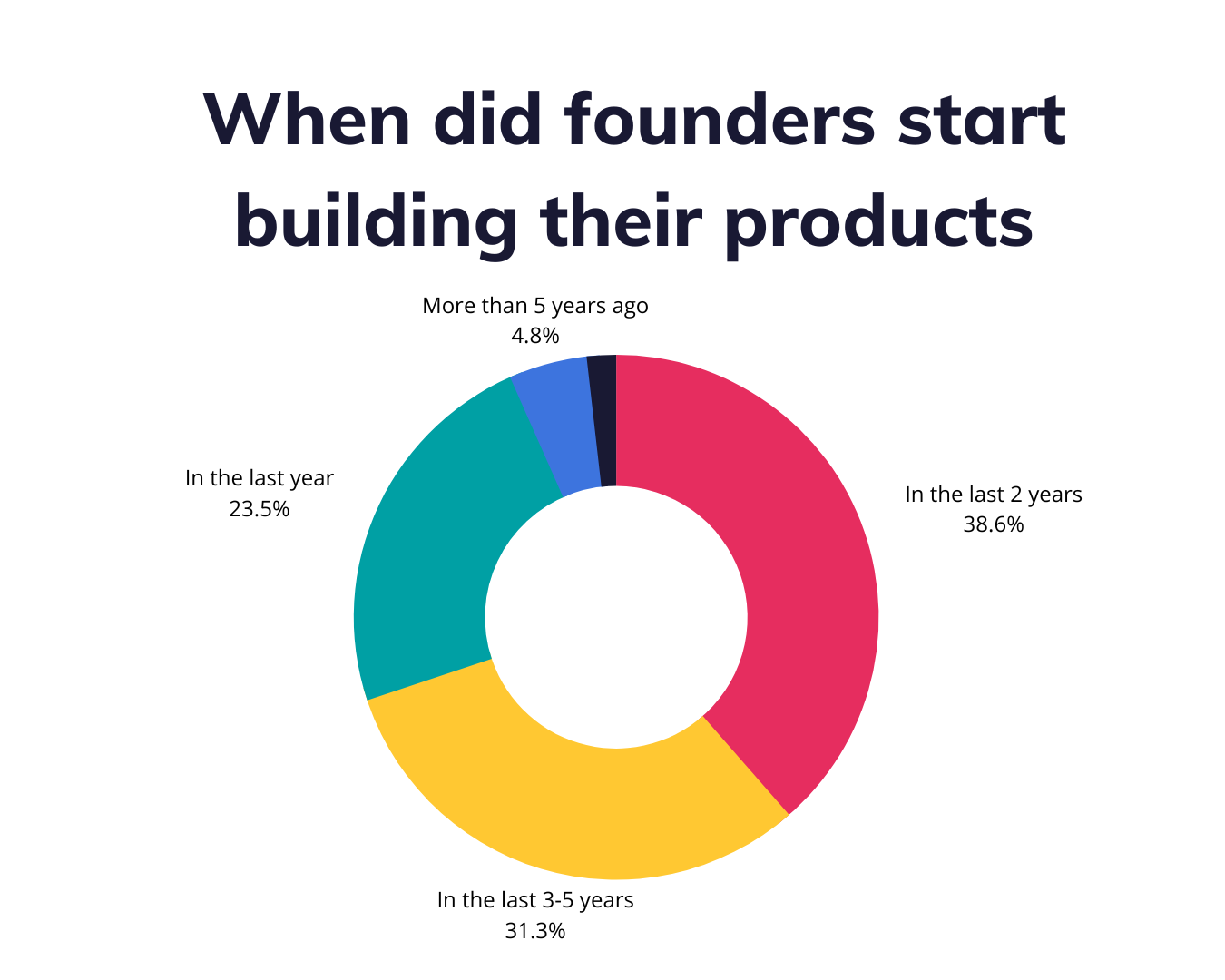

We are aware that Romanians in tech are in essence people of action, doers, builders, but we were wondering for how long now are they building their products?

The largest majority of founders started building their products over the last 2 years (38.6%), followed by those that started building their products over the last 3-5 years (31.3%). There was also an impressive share of 23.5% of founders that started building their products in the last year. 4.8% of founders started building their products more than 5 years ago, whereas only 1.8% of founders started building their products since the beginning of 2023.

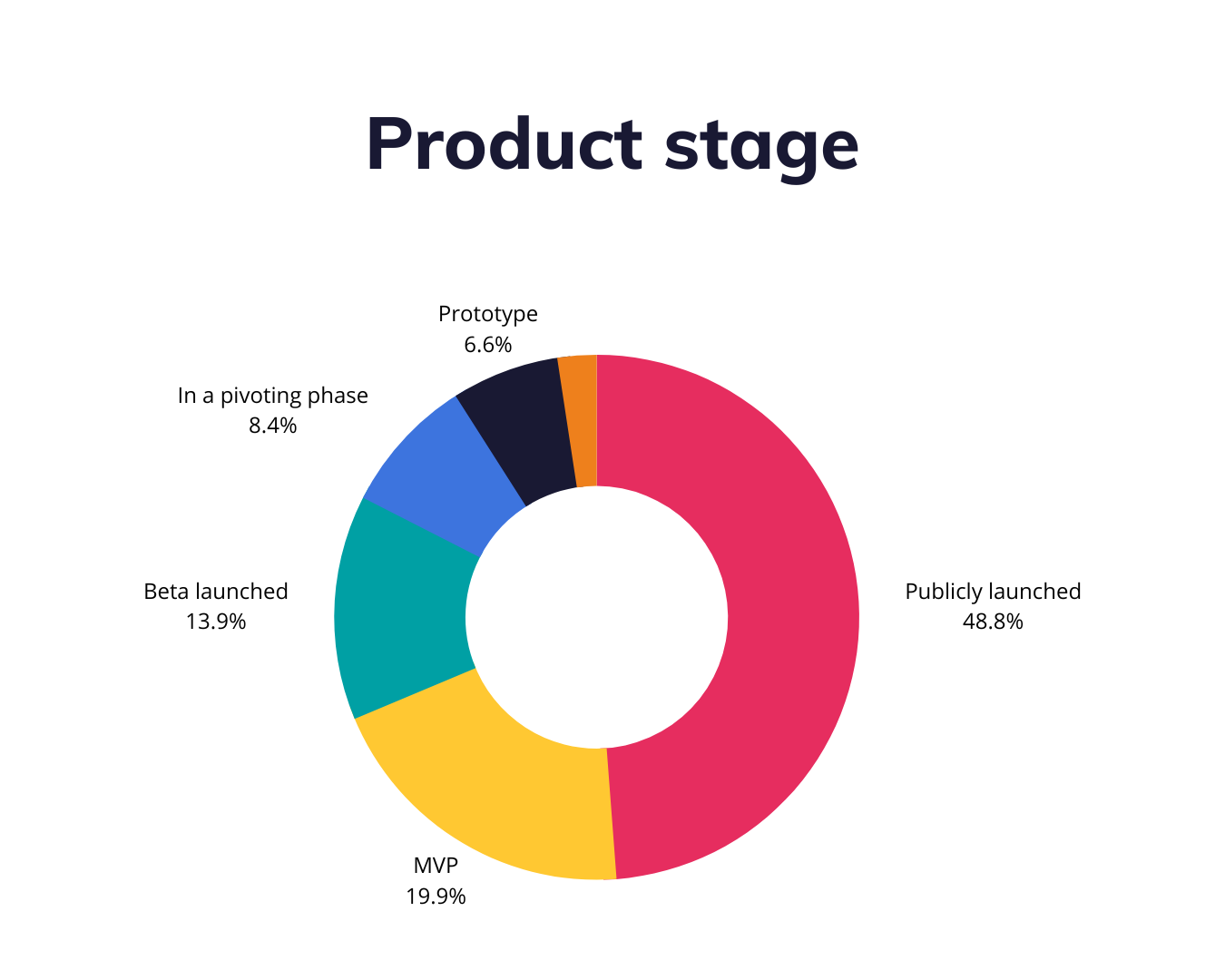

Going deeper into the product dimension, we wanted to understand more about the stage in which products of Romanian-born early stage startups are at the moment.

We got to the following breakdown of startups by their product stage:

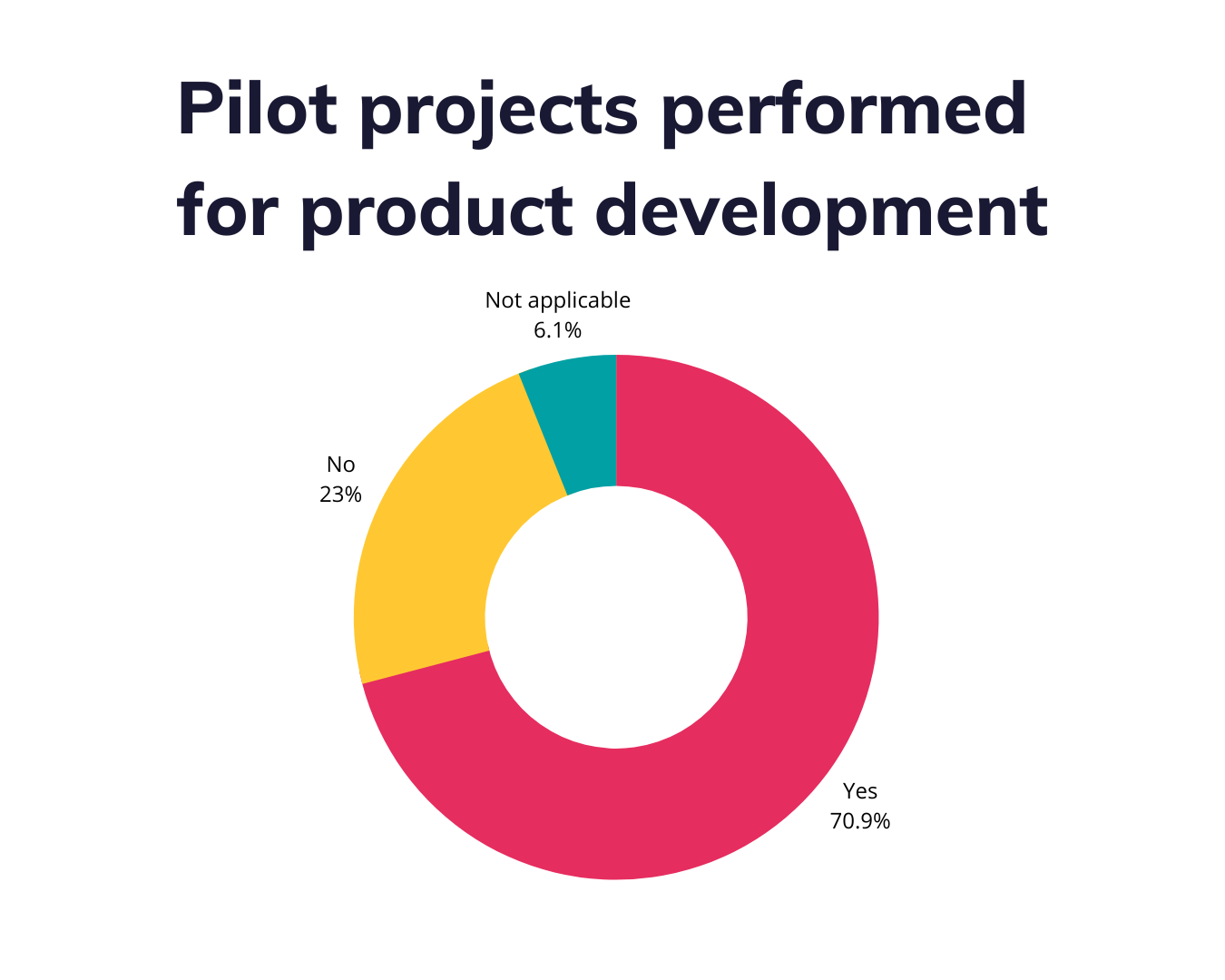

An astonishing share of startups in our data set developed pilot projects – 70.9%, whereas 23.0% didn’t and for 6.1% of them this was not applicable for their products’ development.

In many cases there is tremendous value for startups in doing pilot projects with their potential customers. At the same time we are aware of the collaboration gap between startups and established companies and we address this gap through private meetings and roundtables in which various stakeholders meet and tackle specific challenges and opportunities of an industry.

The upcoming roundtable is related to the health industry and taking place as a private session prior to the Launch Health Tech event on May 18 in Bucharest.

Details in here: Launch Health Tech

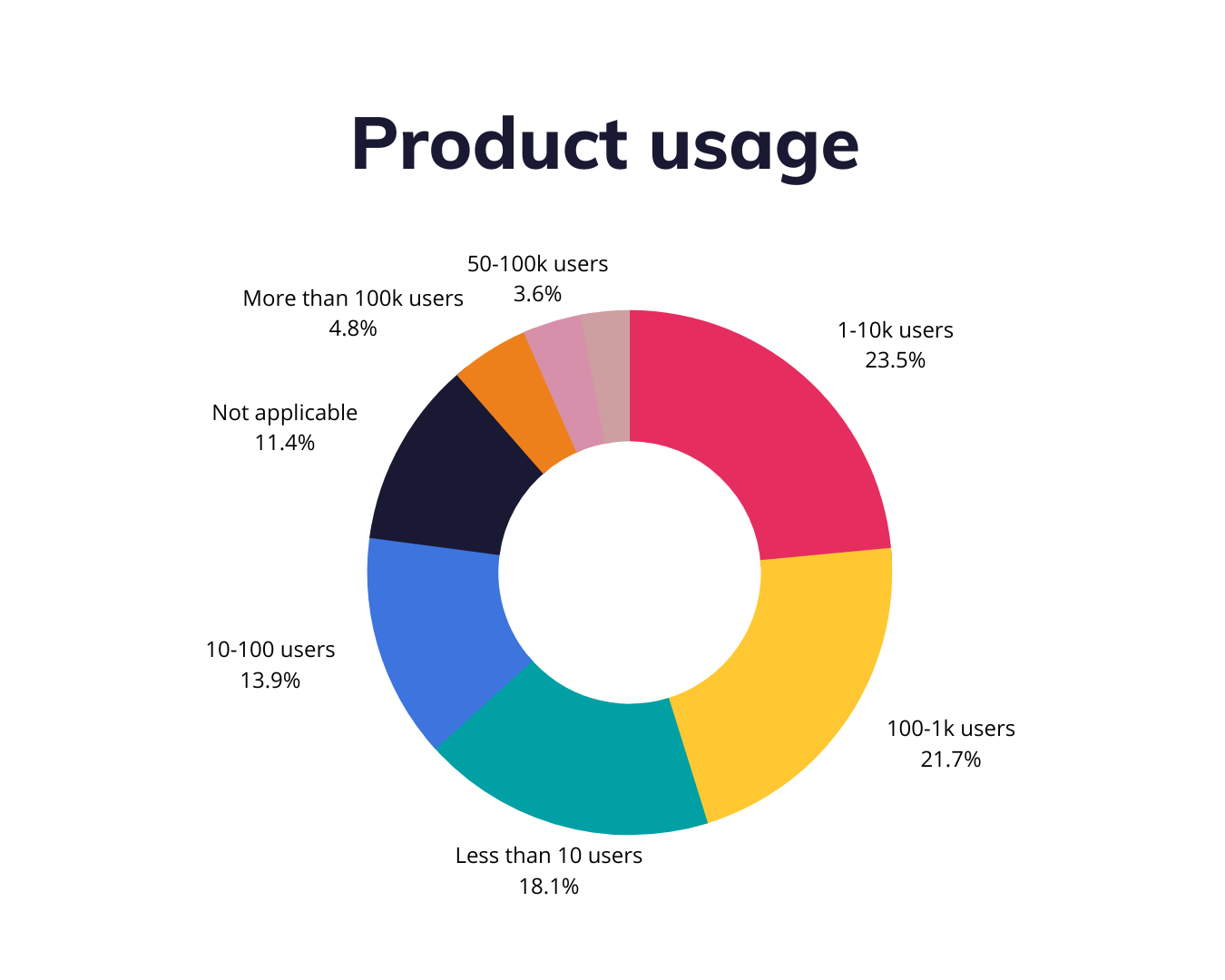

In terms of product usage reported by the founding teams that responded to our survey we can paint the following picture:

This results in a significant majority of startups (77.1%) that yet have very few users, in the range of 10-10k users. This adds to the 11.4% of startups that don’t have any users yet.

There is also the flipside of it, as in contrast we could clearly see that for 11.4% of the startups, their product is being heavily used by their users, ranging from 10k to more than 100k users.

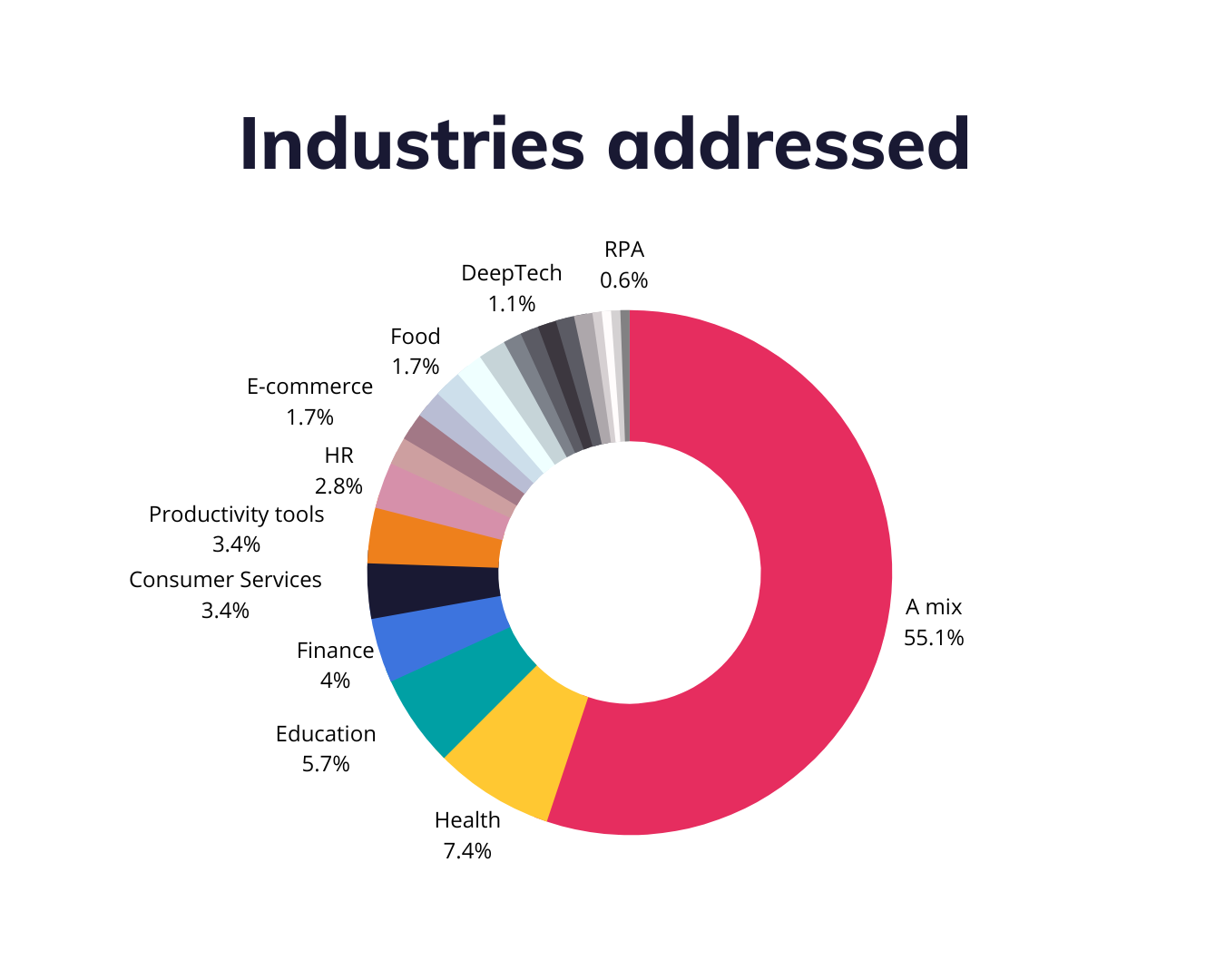

The industries that stand out among all the industries that Romanian-born early stage startups address are Health, Education, Finance, Consumer Services, Productivity tools and HR, summing up 26.7% of the total.

We could also observe that a significant majority of startups (55.1%) address a combination of industries, some of which represented in the following list: Health, Education, Finance, Consumer Services, Productivity tools, HR, Dev tools, E-commerce, Energy, Food, Legal, Real Estate, Automotive, DeepTech, Fashion, Transportation, Web3, Cybersecurity, Entertainment, License management, RPA, AR, Compliance, Film, Gaming, Heavy industry, Retail, Speech recognition.

In terms of the industries their products address, founders had both the options to select from a predefined list of industries, as well as to input the industries according to their own positioning. Here a few examples to give you a glimpse of the variety of answers we received:

or

or

or

and the list could go on for pages.

More often than not, early stage startups are in a continuous search of what’s coined as product/market fit – no more, no less than the holy grail of startups.

And in this stage startups teams have one mission and one mission only – to find something a market wants hard enough and build that something and deliver it to the market.

This is usually referred to as the messy middle, according to Scott Belsky’s book “The Messy Middle”. And There’s a reason why it’s called this way. The ugly truth is that you’re in this messy middle so long you figure out what’s the product/market fit of your endeavor. Getting out implies that you will be able to endure, optimize and (probably the most important) finish whatever you do. Through the book you’ll find that Scott Belsky’s journey building Behance (later acquired by Adobe) can provide help for you to untangle your messy middle.

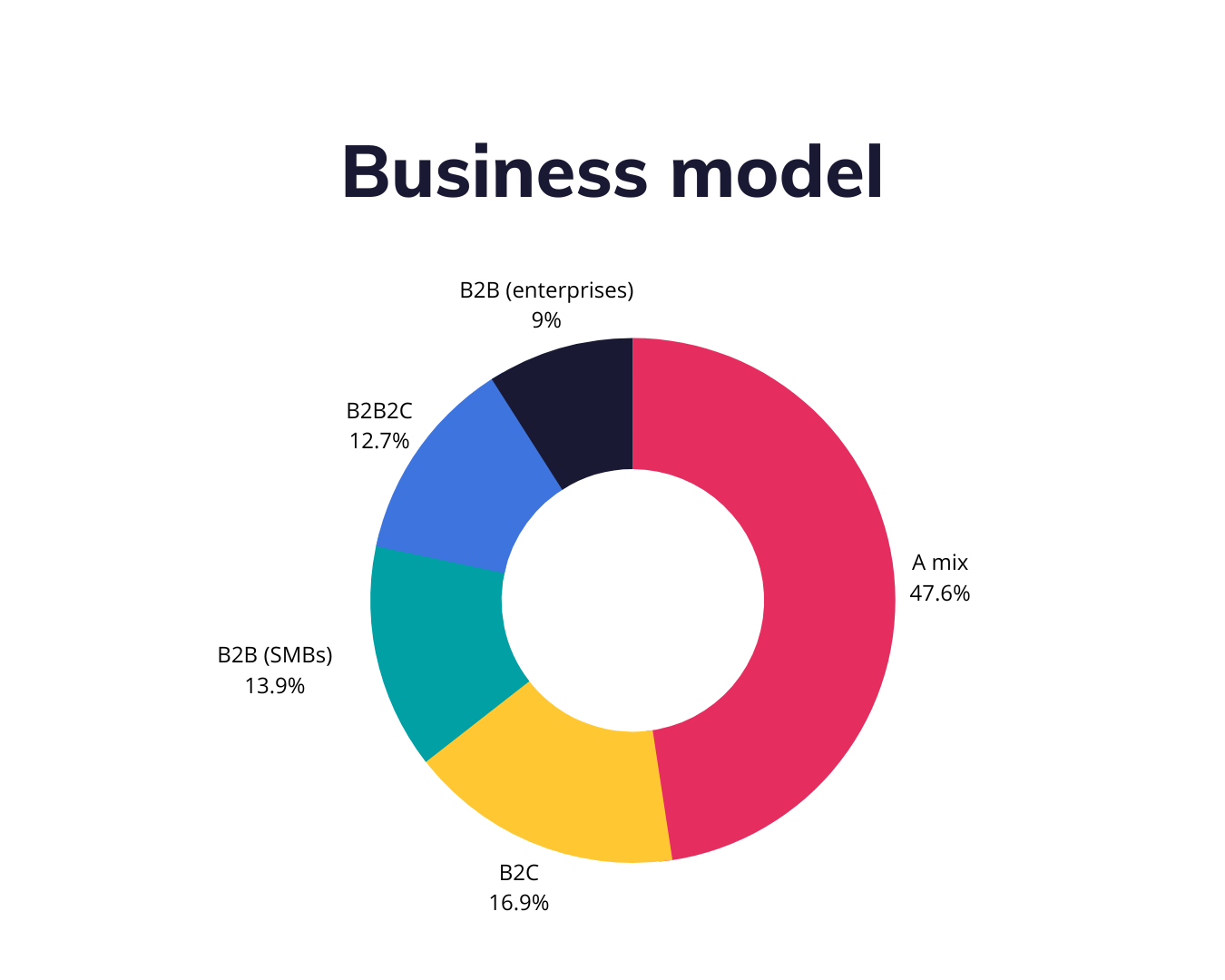

In line with one of the previous data points on industries, so do the business models stand out as follows: B2C (16.9%), B2B – SMBs (13.9%), B2B2C (12.7%), B2B – enterprises (9.0%).

There is also a significant share of startups (47.6%) that at the moment seem to search for the right approach to market as they pointed out a couple of the business models that they’re using.

Here a few examples to give you a glimpse of the variety of answers we received:

and the list could go on for a bit.

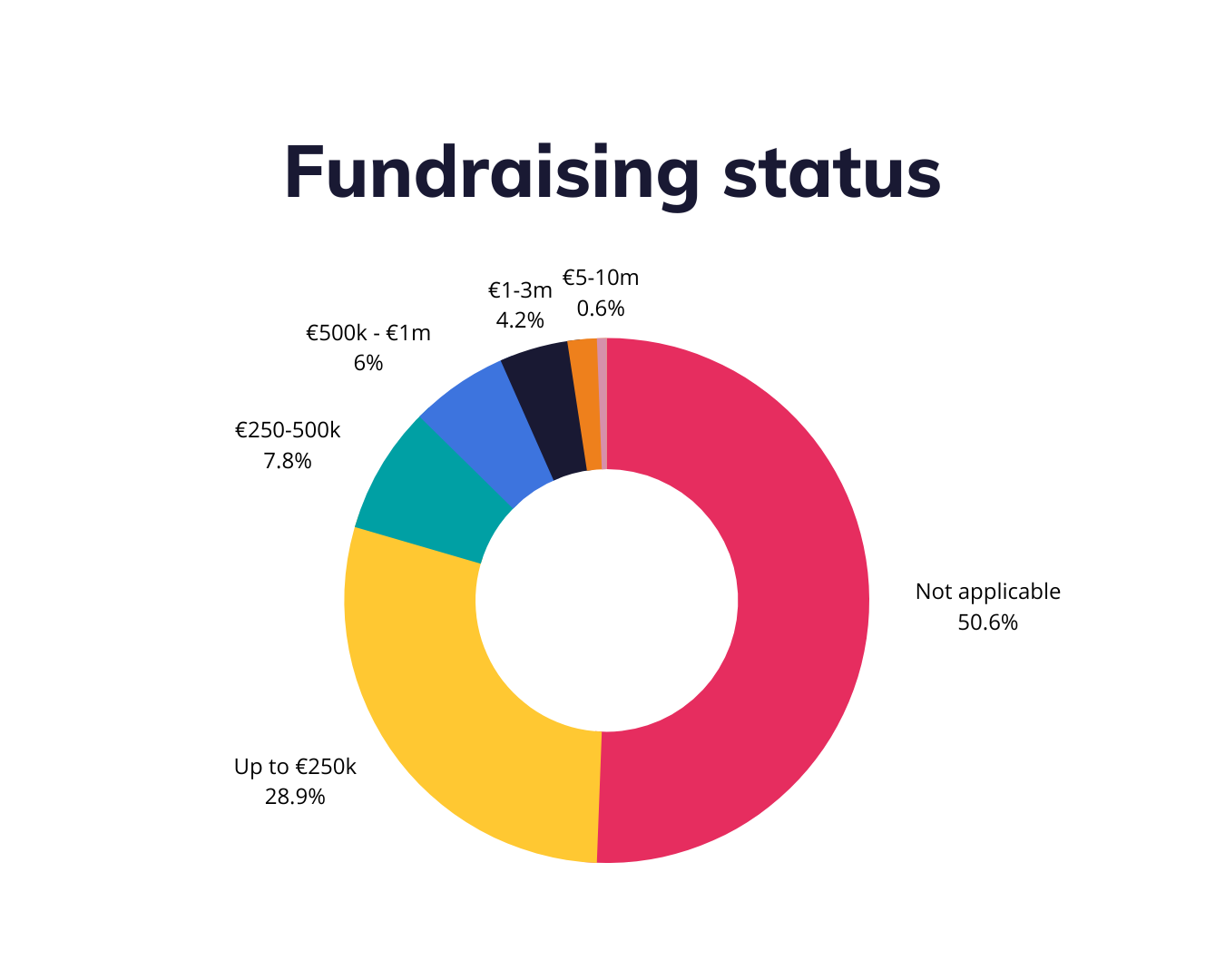

When looking at how Romanian-born early-stage startups fund their endeavors we can first split the group in 2 – those that bootstrapped (50.6%) and those that sought external funding (49.4%).

For the latter bucket we got to the following breakdown:

Looking beyond investments typically raised by early stage startups (pre-seed and seed), we can draw a broader conclusion with regards to the investment deals raised by Romanian-born startups of all stages and that is through the lens of the Romanian Venture Report issued annually by our fellows at How to Web.

Venture deals involving Romanian startups stood up to 2022’s strong headwinds coming from the global tech scene and the global economy in general. Coming out of 2022 we see strong signals that deals involving Romania-born startups can actually turn into a much-wanted bet in one’s portfolio, to say the least.

The sustained growth in transaction volume involving Romanian startups comes as an interesting plot twist in a blurry 2022, considering the turmoil hovering over the global tech scene starting with the year’s second half.

This is a signal in itself, but instead of sending an alarm it sends the following message: “Mayday? On the contrary…”. The local industry worked in spite of some tough regional and global challenges in the technology space. With the global tech scene’s picture in mind, we’re not arguing that navigating the past year and beyond hasn’t posed any serious challenges for the broader Eastern European region. Still, it seems that Romanian-born startups and Eastern European startups, in general, might be well-equipped to weather the storms ahead.

These facts don’t come as a surprise given the credit that the CEE region has in terms of the VC funding’s growth, CEE being currently one of the fastest growing regions for VC funding in Europe, with a 7.6x growth since 2017.

The total volume of deals in 2022 rose near the level of the previous year’s volume – €101.7M compared with €116.9M in 2021*. It’s worth mentioning that 2021’s transaction volume accounts for FintechOS €51M series B.

This supports Romania’s 5th position in the top CEE countries by VC funding raised in 2022, mentioned in the CEE Startups 2022 report by Dealroom, coming right after Estonia, Czechia, Croatia, and Poland, which hold 70% of the total volume.

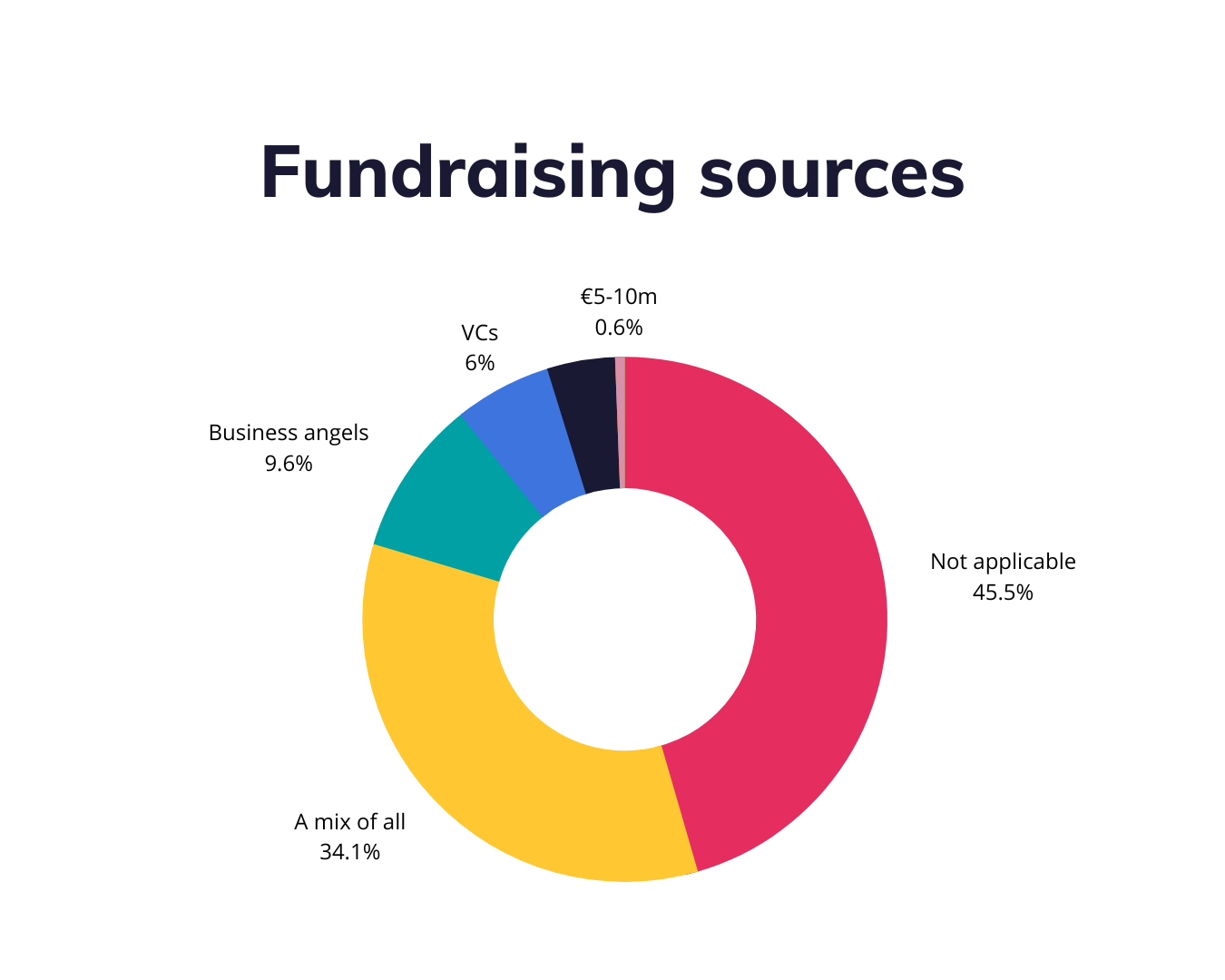

From a previous point in the report it became obvious that external funding is not applicable for most Romanian-born early stage startups, a fact shown in the responses below – 45.8% responding that they are self-funded / bootstrapped.

When it comes to the other half we came down to the following split:

In the above mentioned 34.3% of startups that are funded by a mix of all / some of the funding sources or other, here are few examples to give you a glimpse of the variety of answers we received: “community crowdfunding / web3”, “accelerators and European Funds”, “grants + competitions + incubators” and similar to these.

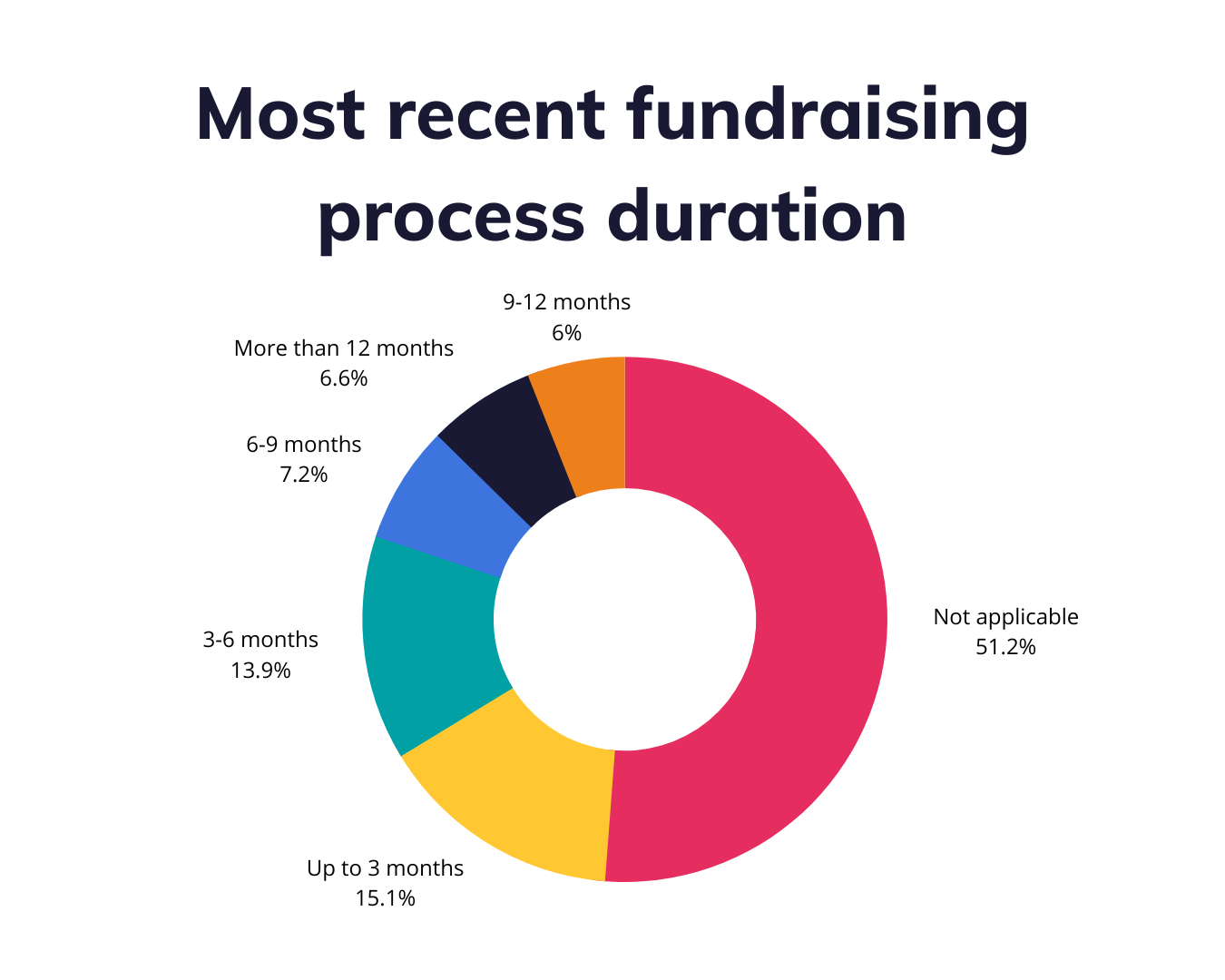

Although roughly half of startups in our data set for this question responded that external fundraising was not applicable (51.2%), when tapping on the duration of all the others’ most recent fundraising processes (48.8%) we found out that:

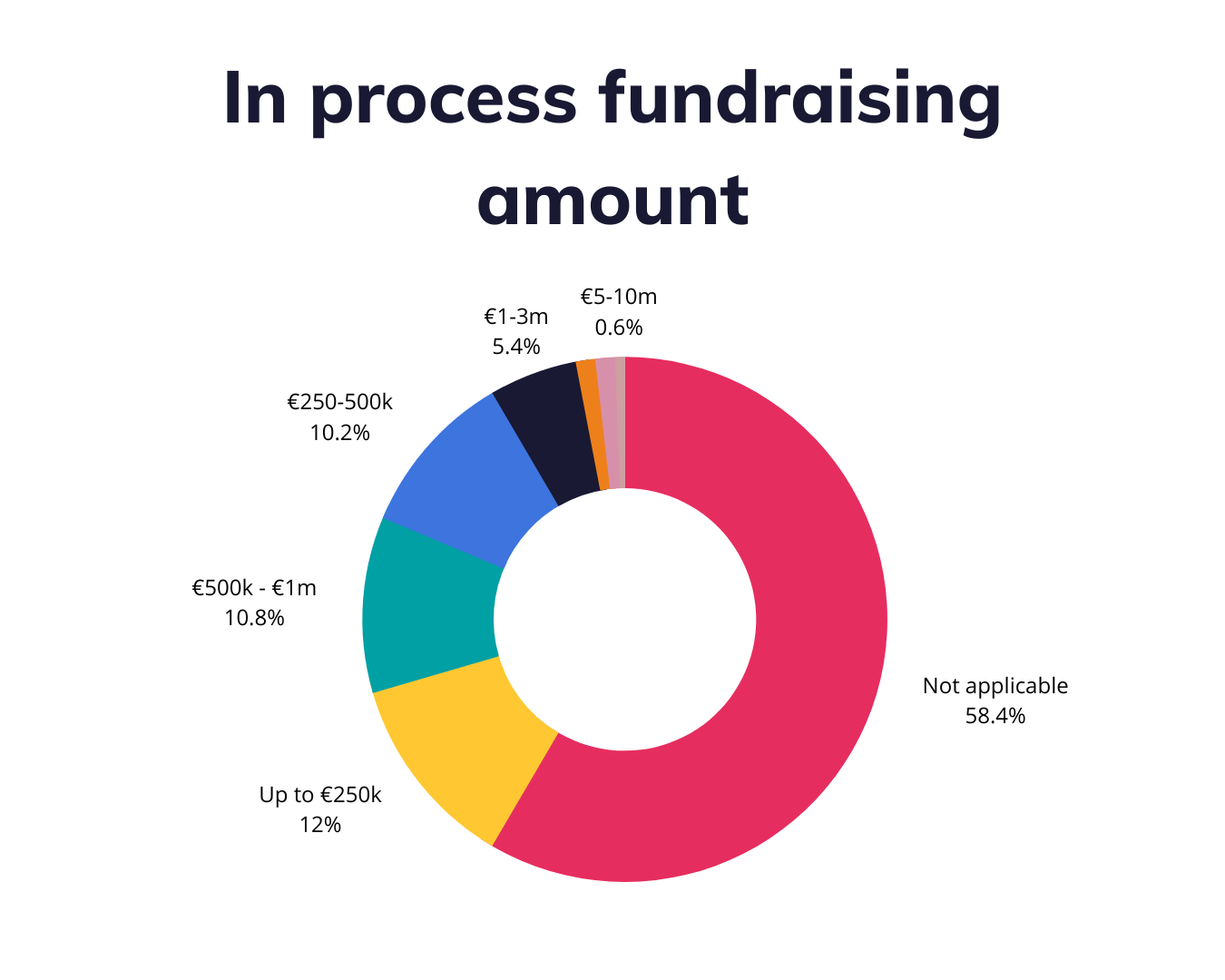

Although roughly half of startups in our data set for this question responded that external fundraising was not applicable (58.4%), when tapping on the fundraising amount of all the others’ (41.6%) we found out that:

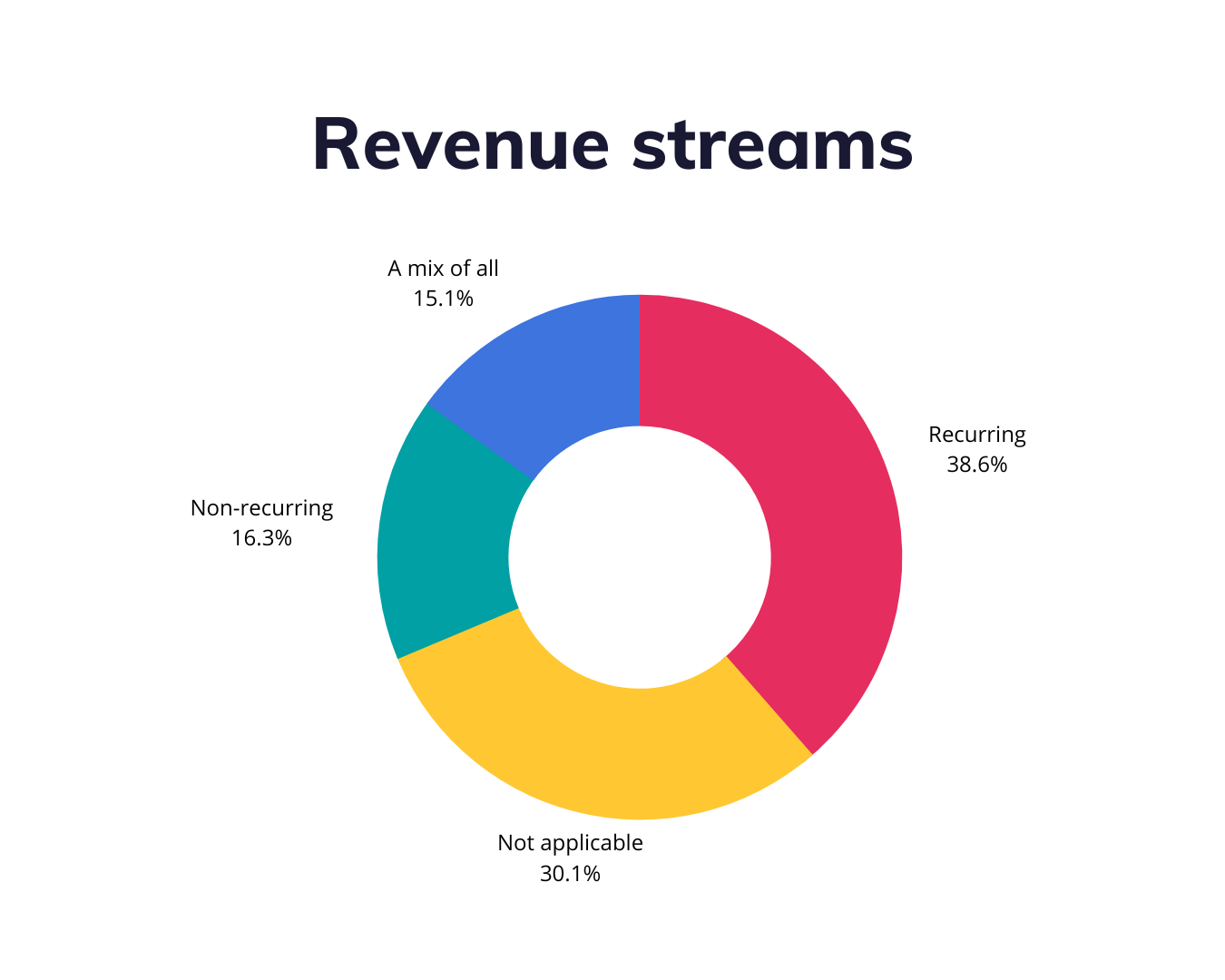

For 30.1% of early stage startups monetizing is not applicable yet.

However, for the early stage startups that generate revenue at this stage (69.9%) we found out the that:

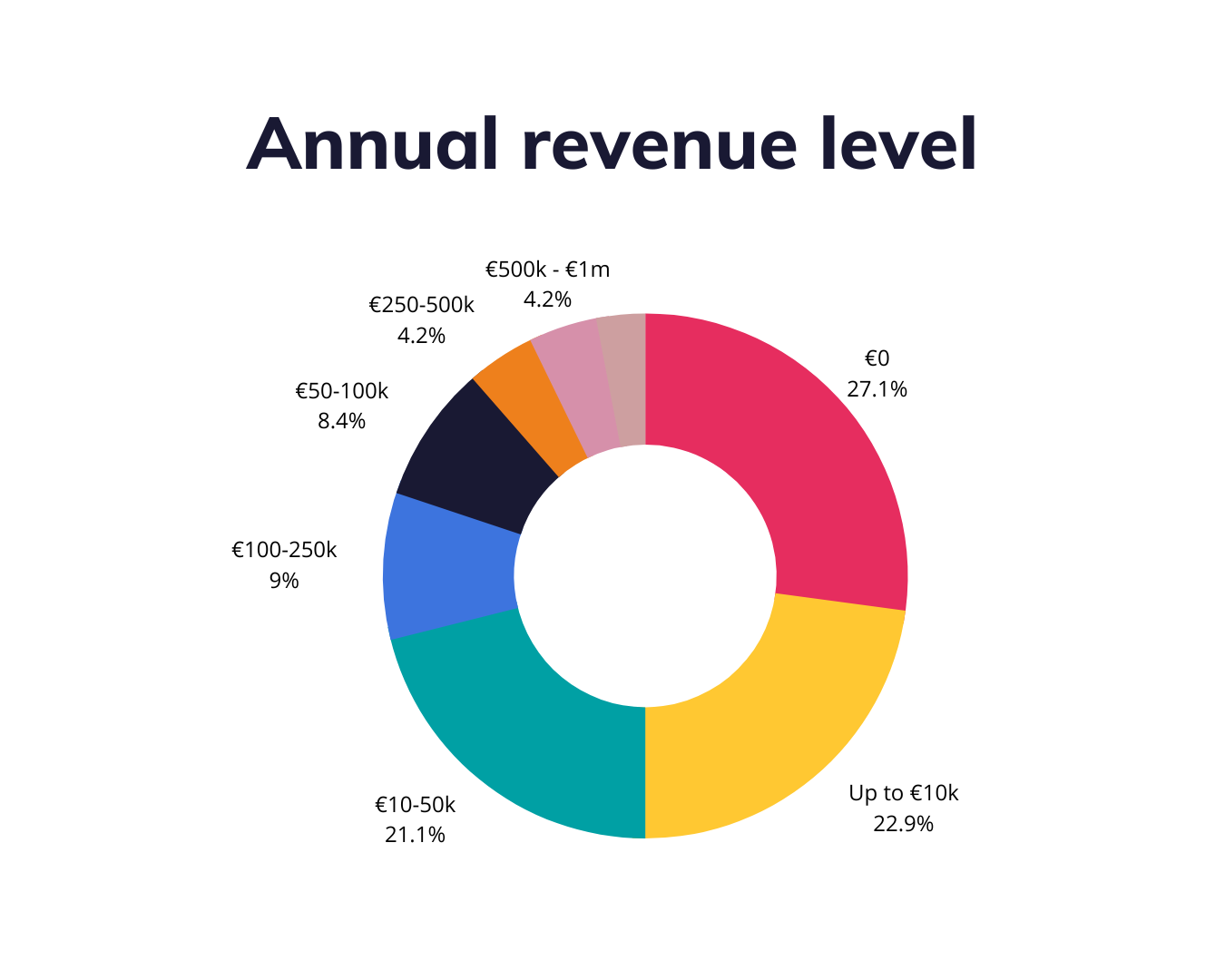

Taking a last step forward into the revenue dimension of Romanian-born early stage startups we assessed the level of their annual revenue. We found out the that:

Although all previous points tackling the business model and revenue sides of a startup are not surprising, we would love to see more and startup teams finding a way to monetize their products as early on as possible.

And with the support such as the recurring cycle of problem-solving sessions founders have access to as part of the community we can see how product related matters as well as business and team related matters and anything in between and find solutions within an online or hybrid session part of the dozens of such session that take place every year within the community.

Within the survey we used for collecting grass-root data points from founding teams, we’ve reserved open ended questions through which founders can share their thoughts in respect with a few other dimensions that together with the previous ones could form a more accurate state of the Romanian-born early stage startups.

These open-ended questions allowed an additional great deal of insights about matters such as:

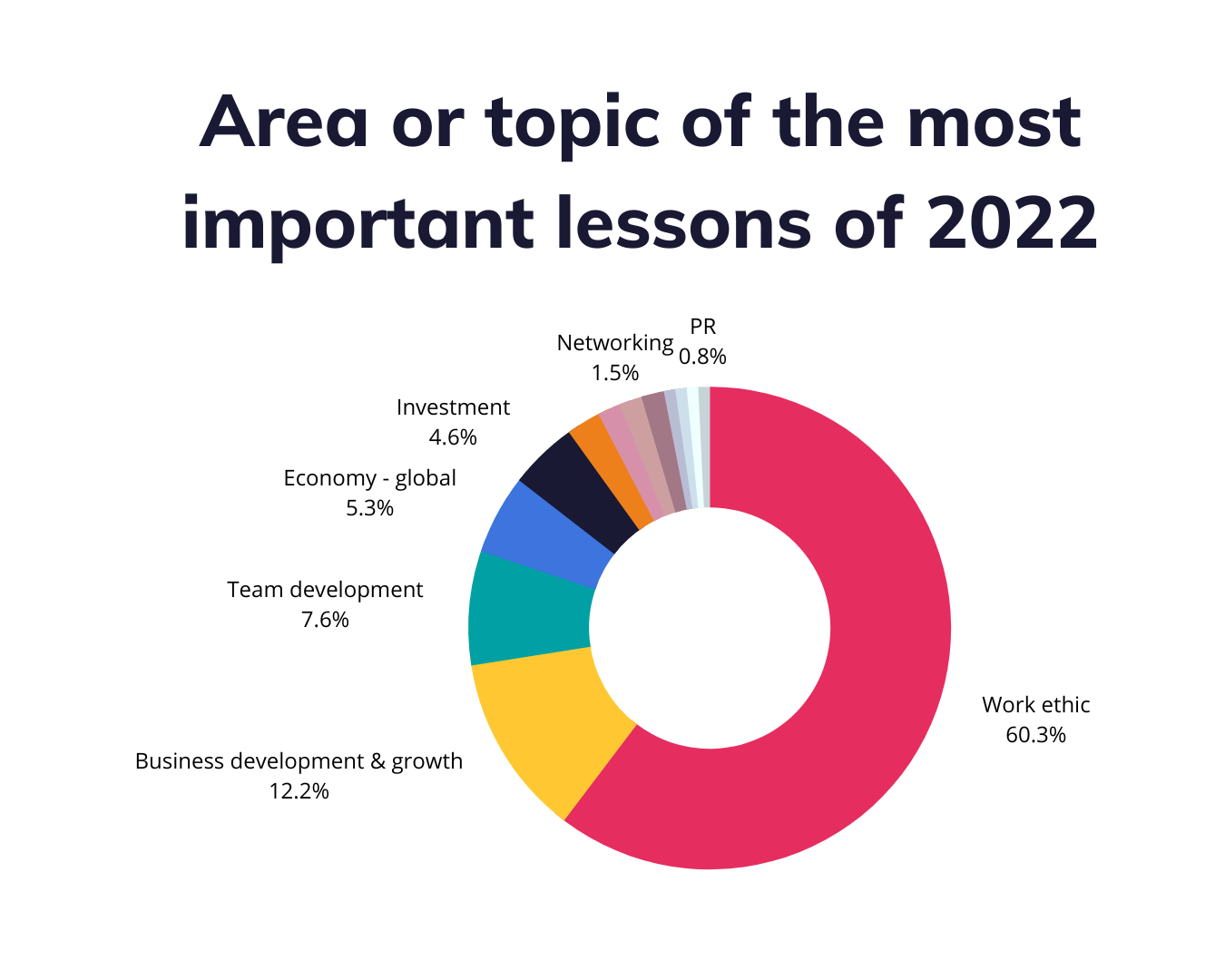

Delving into the area / topic of the most important lessons of 2022 for founders we found out that these tend to gravitate around the following:

Although these questions were optional in contrast to all the previous ones tackling team, product, business, funding and revenue dimensions, we received on average as many answers as we did for the mandatory ones.

We were mesmerized by the answers, so here are few examples to give you a glimpse of the variety of answers we received on this matter:

and the list could go on for pages.

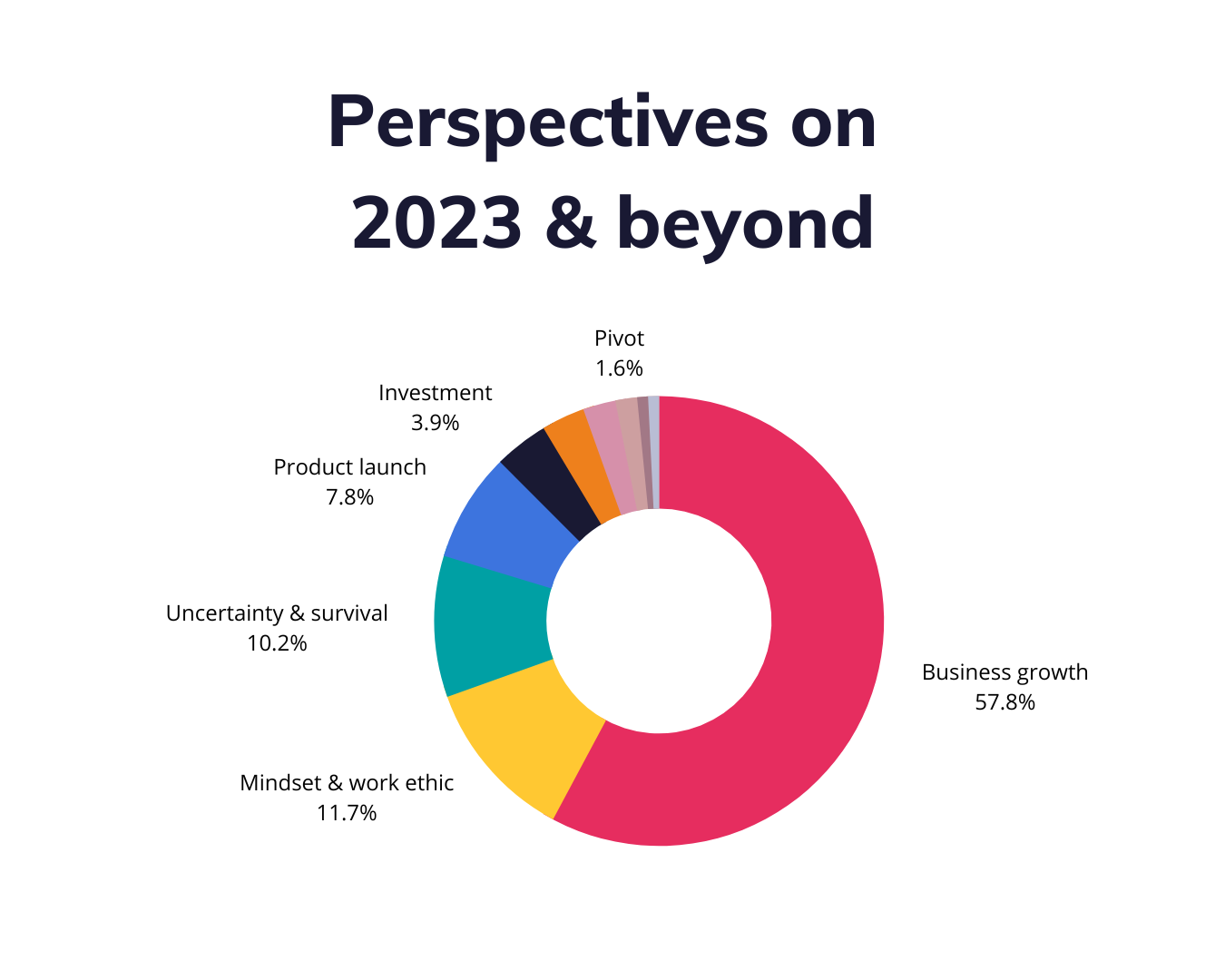

Going forward we asked founders to share their perspectives on 2023 and beyond and we could break down their thoughts into the following taglines that we managed to fit their various answer to:

Here are few examples to give you a glimpse of the variety of answers we received on this matter:

and the list could go on for a while.

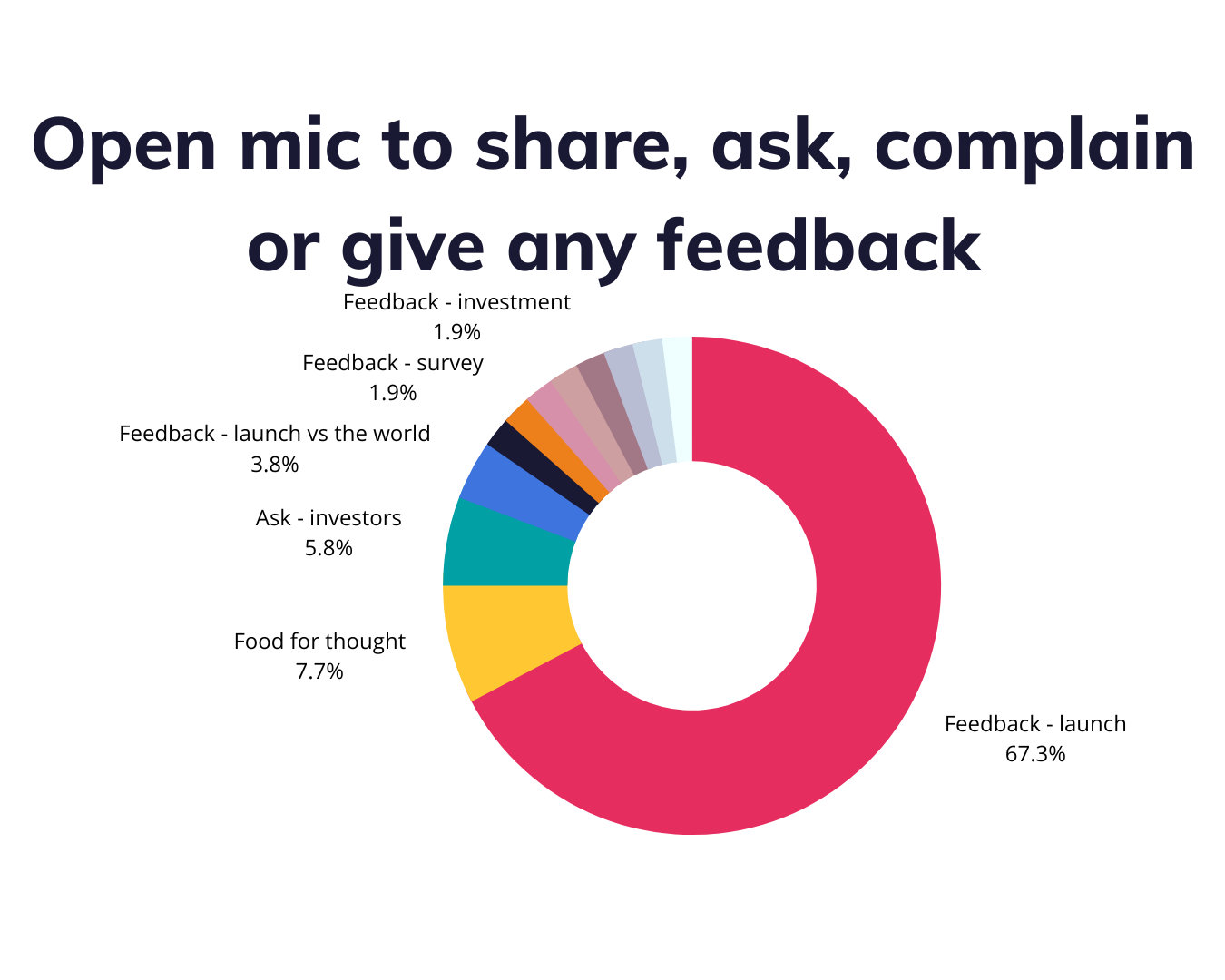

When asked to share (absolutely) anything with us, founders’ responses fell into the following categories:

Here are few examples to give you a glimpse of the variety of answers we received on this matter:

and the list could go on for a while.

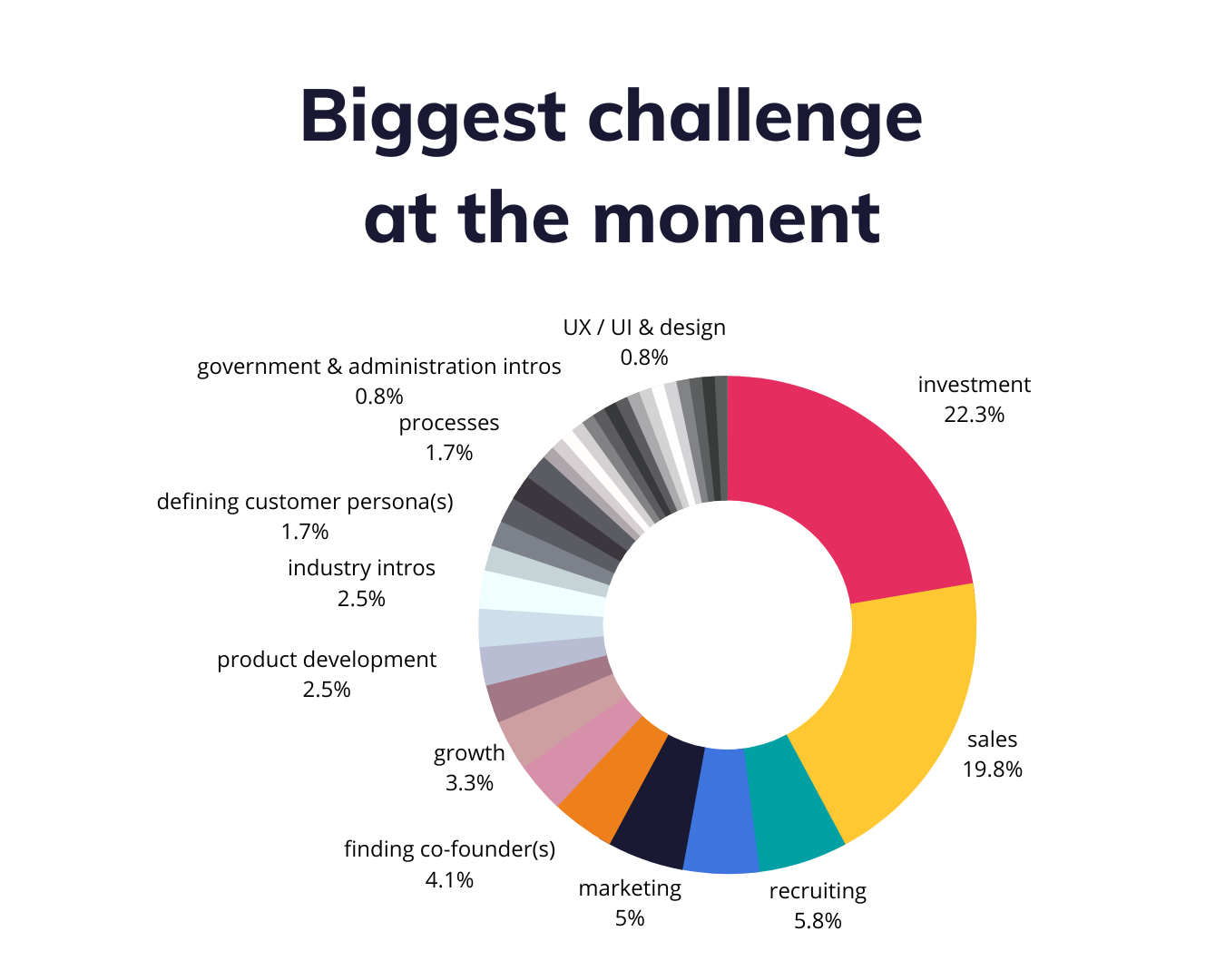

When reflecting on their biggest challenges, founders of Romanian-born early stage startups “opened up their kimono” and are showing us all how vulnerability is actually a trait of leaders in becoming; we could tag and split their challenges into the following types:

Here are few examples to give you a glimpse of the variety of answers we received on this matter:

and the list could go on for a while.

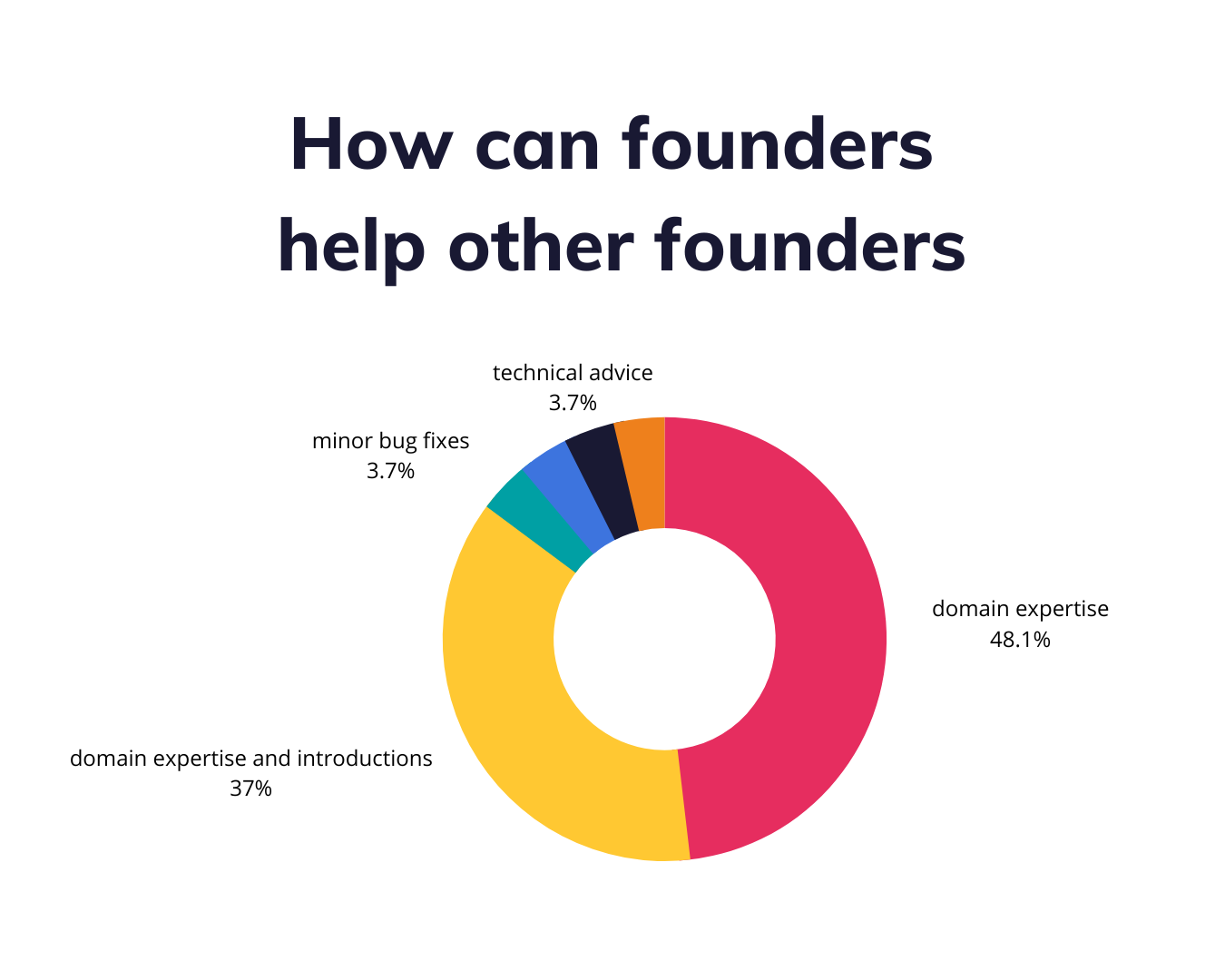

In any healthy ecosystem and community, its members are as much concerned about what they give back as to what’s in it for them.

And this is the same signal we got when looking at how founders reacted when we asked them about how they can help fellow founders. A breakdown of their responses opens up the following ways in which founders can help each other:

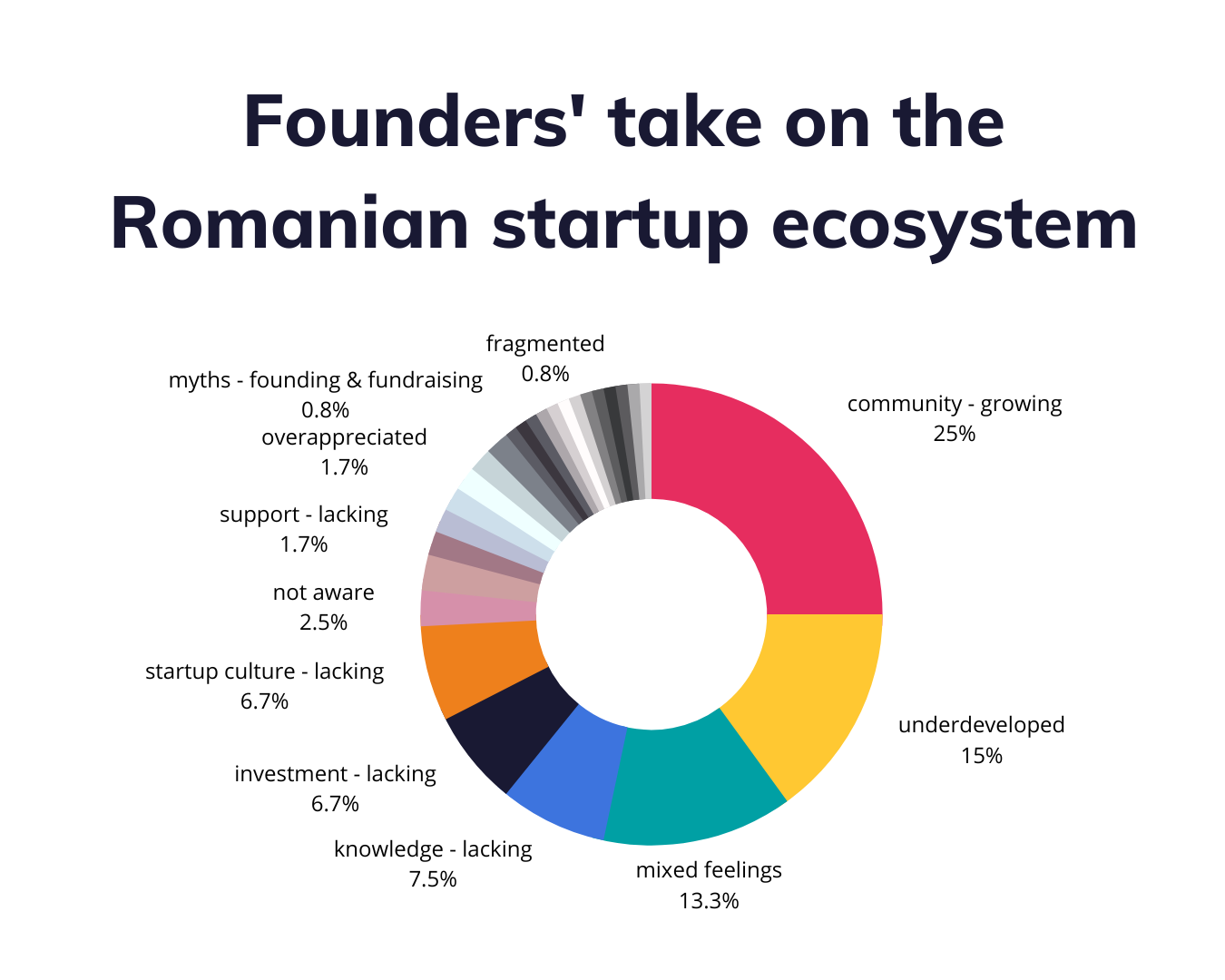

Sparkling insights are not over yet. Now we know and can share how founders think of the ecosystem. Their reactions were mainly falling into the following:

Here are few examples to give you a glimpse of the variety of answers we received on this matter:

Bad: As a B2B founder I get a lot of pushback from companies when I approach them to pitch, and I see a lot of reluctance in making them try new, innovative solutions, be it even in a pilot phase, so no strings attached. It would be cool if Romanian companies would somehow be encouraged to consume more tech products from local startups, the same way we are all encouraged to consume local grocery products when we go shopping.”

Cons: The investment rounds are really small compared with Western Europe.”

and the list could go on for a few long scrolls.

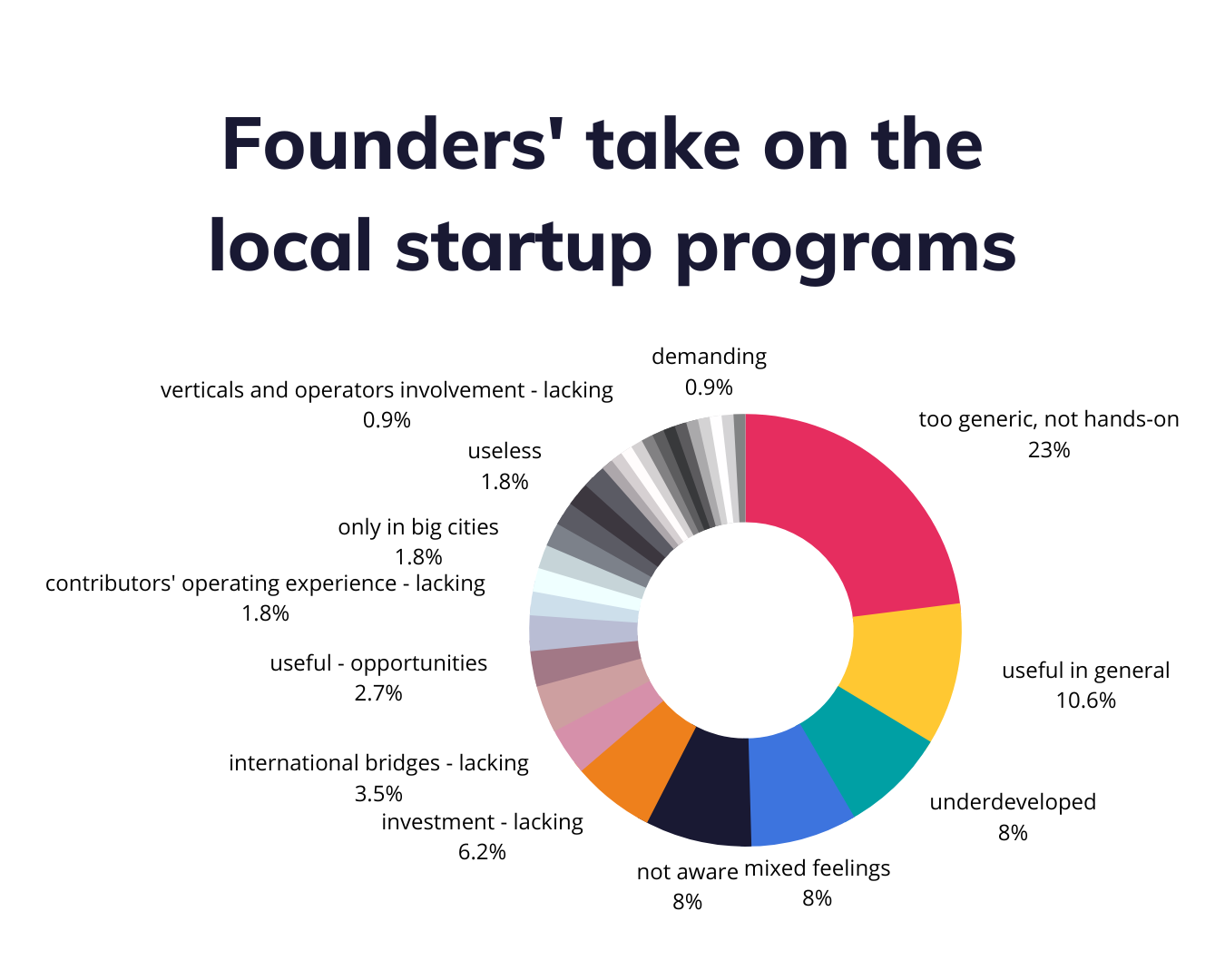

Other extremely valuable insights are coming from their perspectives on the local startup programs; their take on this type of support could be described as follows:

Here are few examples to give you a glimpse of the variety of answers we received on this matter:

and the list could go on for quite some time.

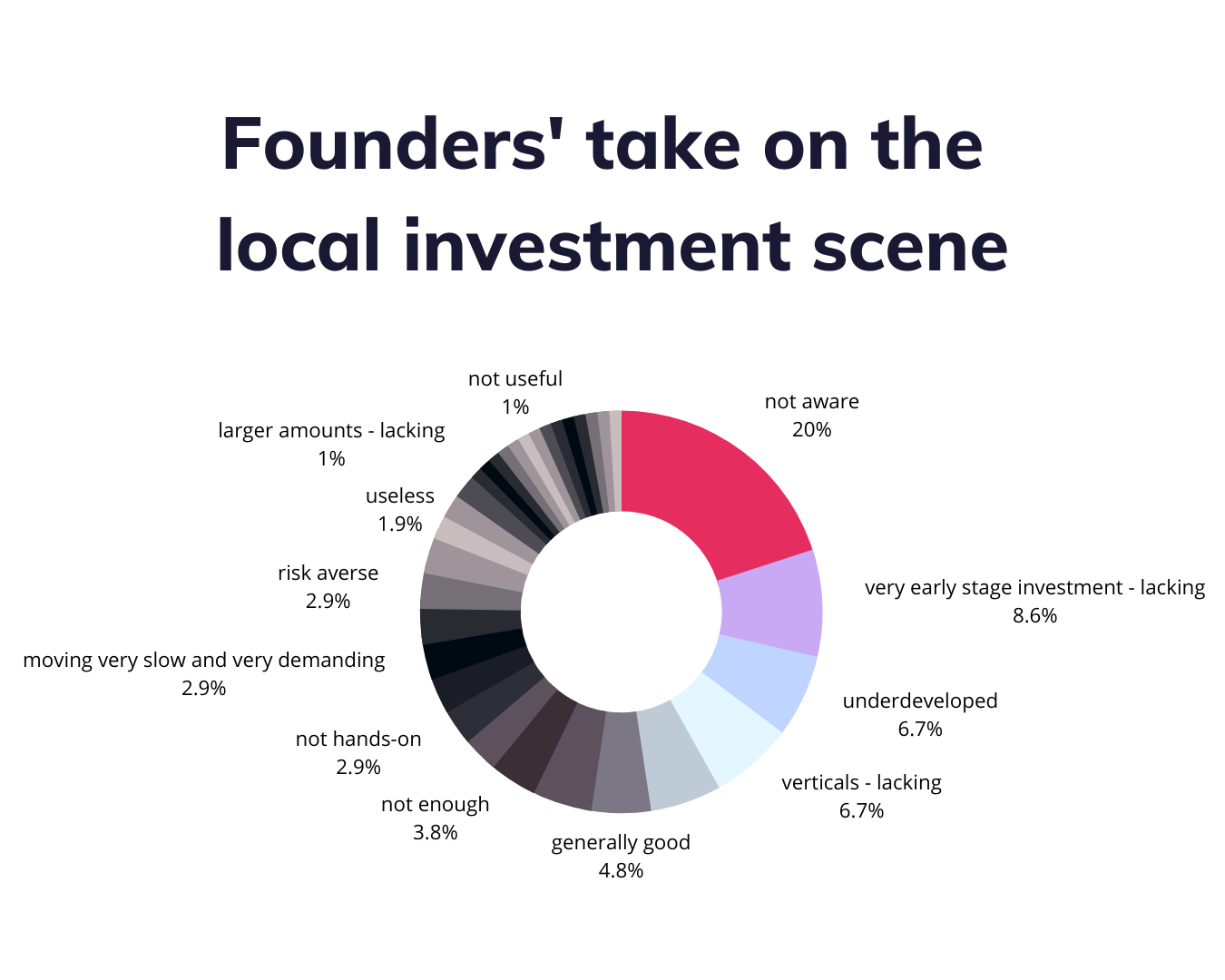

When looking at the local investment scene, founders’ take on this type of support would fall into the following buckets:

Here are few examples to give you a glimpse of the variety of answers we received on this matter:

and the list could go on for a while.

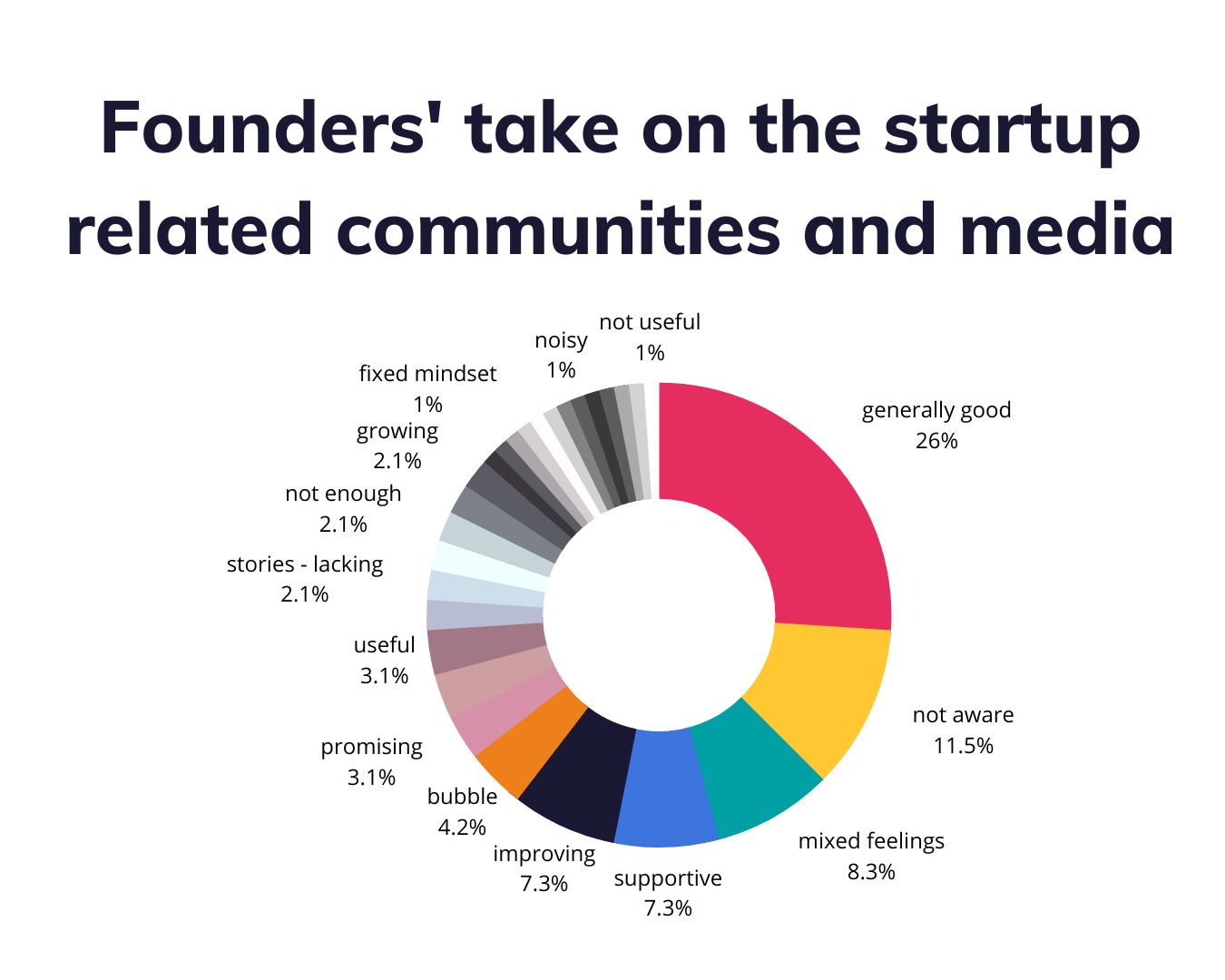

Communities and media are part of the fabric of any thriving ecosystem. When we asked to share their take on these ecosystem players, founders’ reactions found themselves under one of the categories below:

Here are few examples to give you a glimpse of the variety of answers we received on this matter:

and the list could go on for some while.

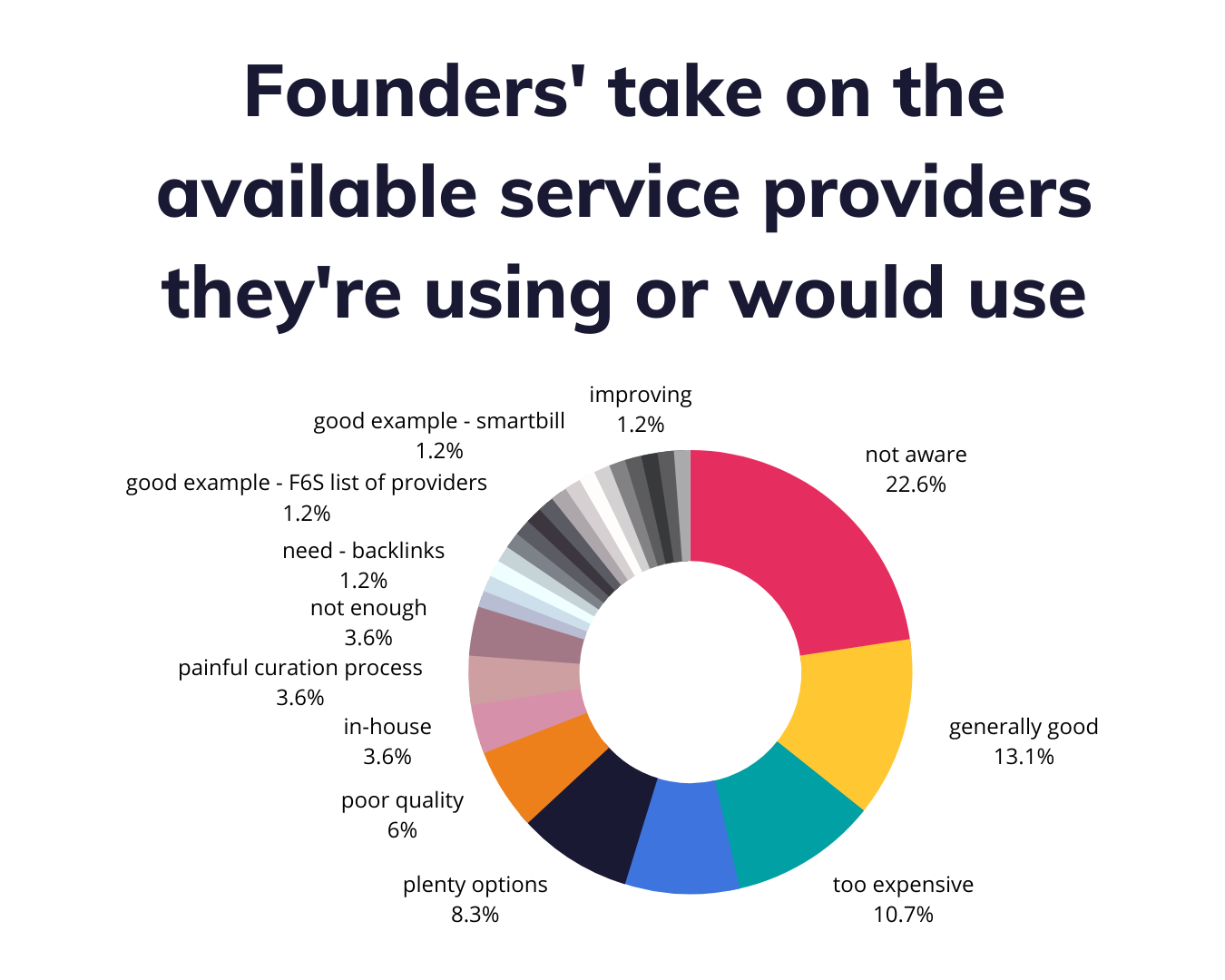

Here are few examples to give you a glimpse of the variety of answers we received on this matter:

and the list could go on for a while.

As every great endeavour, we got to the end of this year’s edition of the Launch Annual Report, thanks for reading!

Make sure you spread the information and insights with your peers and network and hope to see you at the upcoming community event we’re prepared for you – Launch Health Tech, on May 18 in Bucharest at Apollo 111!🙂

Throughout the data collection process we received 166 survey responses from founders of Romanian-born early stage startups. Out of all the responses, 31.3% were from founders that were already part of Launch community, whereas 68.7% were responses received from founders

When we say Romanian-born we mean that from a founding team perspective all or at least the majority of the founding team members have Romanian roots.

What we mean when we say early stage startups:

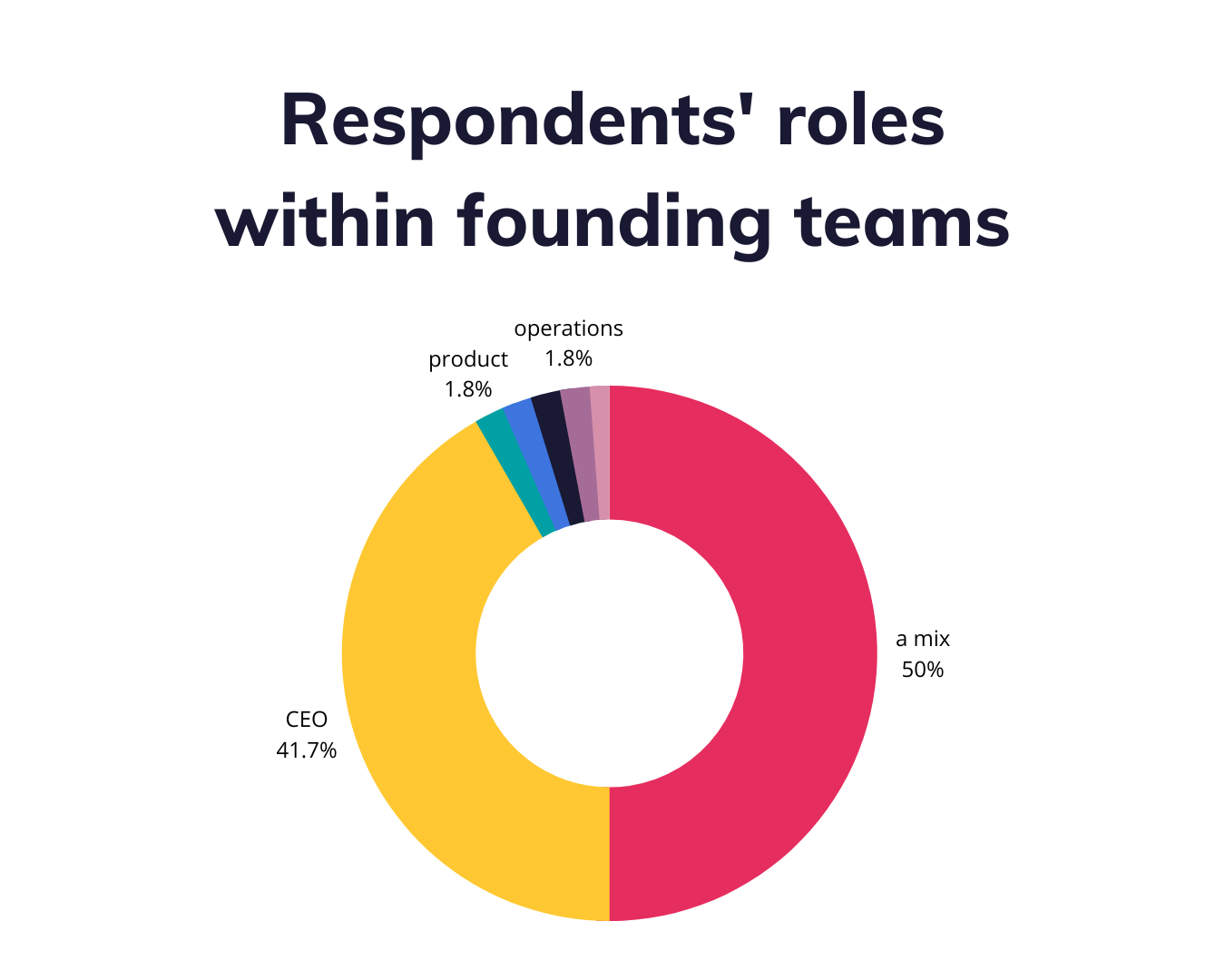

When we look at the data gathered through the survey we can see that our respondents wore various hats within their founding teams, namely:

Through the lens of this edition’s report we could see 2022’s challenges being faced respectably by Romania-born startups. In turn throughout 2022 they managed to build their products, grow their teams in spite of the uncertainty in the market. It’s as if founders and all those around them said “hold my beer!”.

Word goes that the past is a good predictor of the future and as it seems, the Romanian-born early stage startups are on a right path.

We don’t know for a fact what 2023 will show us, but what we do know is that we’re here to nurture the place where Romanian founders and talent in technology grows – Launch Community.

Until we meet again in here for the next edition of the Launch Annual Report, we can’t wait to see you at the upcoming community event – Launch Health Tech, May 18, Bucharest.

Let’s keep in touch on:

Launch Community 2023 co-organizers:

Communities:

Hub-uri și spații de coworking:

Hackathons:

Pre-accelerators:

Accelerators:

Equity crowdfunding platforms:

Business angel groups:

VCs:

Conferences:

Media:

We also recommend you to at least skim through the following reports and listicles issued by some of our ecosystem friends. We consider them noteworthy given the discussions stirred by the endeavour carried out by Launch Annual Report.

Reports

Listicles and other useful piece of information

Press Release, September 13, 2023 After a successful first edition organised in May 2023, Launch […]

Citeste mai mult

Ai o idee de business. Una în care crezi mult. Bun, bun, dar întrebarea e […]

Citeste mai mult

Comunicat de presă, 19 mai 2023 Două noi proiecte românești în industria de tehnologie pentru […]

Citeste mai mult

Comunicat de presă, 3 mai 2023 Launch Health Tech, primul eveniment dintr-o serie dedicată ecosistemului […]

Citeste mai mult

Scena locală de startup-uri, tehnologie și inovație se întâlnește pe 20 septembrie, înainte de How […]

Citeste mai mult

Scorul BRICE (găsești aici un template de framework) îți oferă un mod consistent de-a evalua, într-un mod obiectiv, viitoare sau potențiale dezvoltări de produs.

Citeste mai mult

Pirate metrics este printre cel mai cunoscut set de metrici și acronimul vine de la: Acquisition, Activation, Retention, Referral, Revenue.

Citeste mai mult

Lean Canvas răspunde unei nevoi cheie pentru startup-ul tău: aceea de documentare a planului pe care îl ai pentru acesta și, mai mult decât atât, te ajută să identifici asumpțiile majore pe care le ai.

Citeste mai mult

Pe lângă energie și entuziasm, într-un startup tech ai nevoie de un set de instrumente care să te ajute să dezvolți un produs de succes.

Citeste mai mult